Island Park in ‘significant’ fiscal stress

The office of State Comptroller Tom DiNapoli has issued a scathing report on the Village of Island Park’s finances, indicating that current fiscal practices could jeopardize local services and lead to tax increases. The current administration, however, disputed the assessment.

The March 22 report put the village’s fiscal stress rating for the 2017 fiscal year at “significant,” the highest level under DiNapoli’s Fiscal Stress Monitoring System, and cited a poor fund balance relative to total revenues and an operating deficit as the chief drivers of the designation. It is the first year the village has received a fiscal stress rating since the development of the system in 2012.

The state said that the monitoring system — meant to serve as an early warning to local governments to help head off fiscal problems that could lead to tax increases and service cuts — uses financial indicators including year-end fund balances, short-term borrowing and patterns of operating deficits, and creates an overall fiscal stress score for a municipality: “significant” or “moderate” fiscal stress, “susceptible to fiscal stress” or “no designation.”

DiNapoli’s office evaluated 529 villages and 17 cities throughout the state, and found that 10 villages and two cities had some level of fiscal stress in 2017. Using a point scale of 0 to 100, with 100 being the worst possible score, the system gave Island Park a rating of 78.3.

“Our system reviews the finances of local governments at the end of the fiscal year,” said Brian Butry, a spokesman for DiNapoli’s office. “And the numbers are what they are.”

Mayor Michael McGinty responded by saying that the report was mistimed, and that the village was waiting for reimbursements from various agencies that would eliminate the negative fund balance by the end of the fiscal year in June. “The reality is that there is no negative fund balance,” he said, and added that reimbursements from state, federal and county governments were due in the coming weeks.

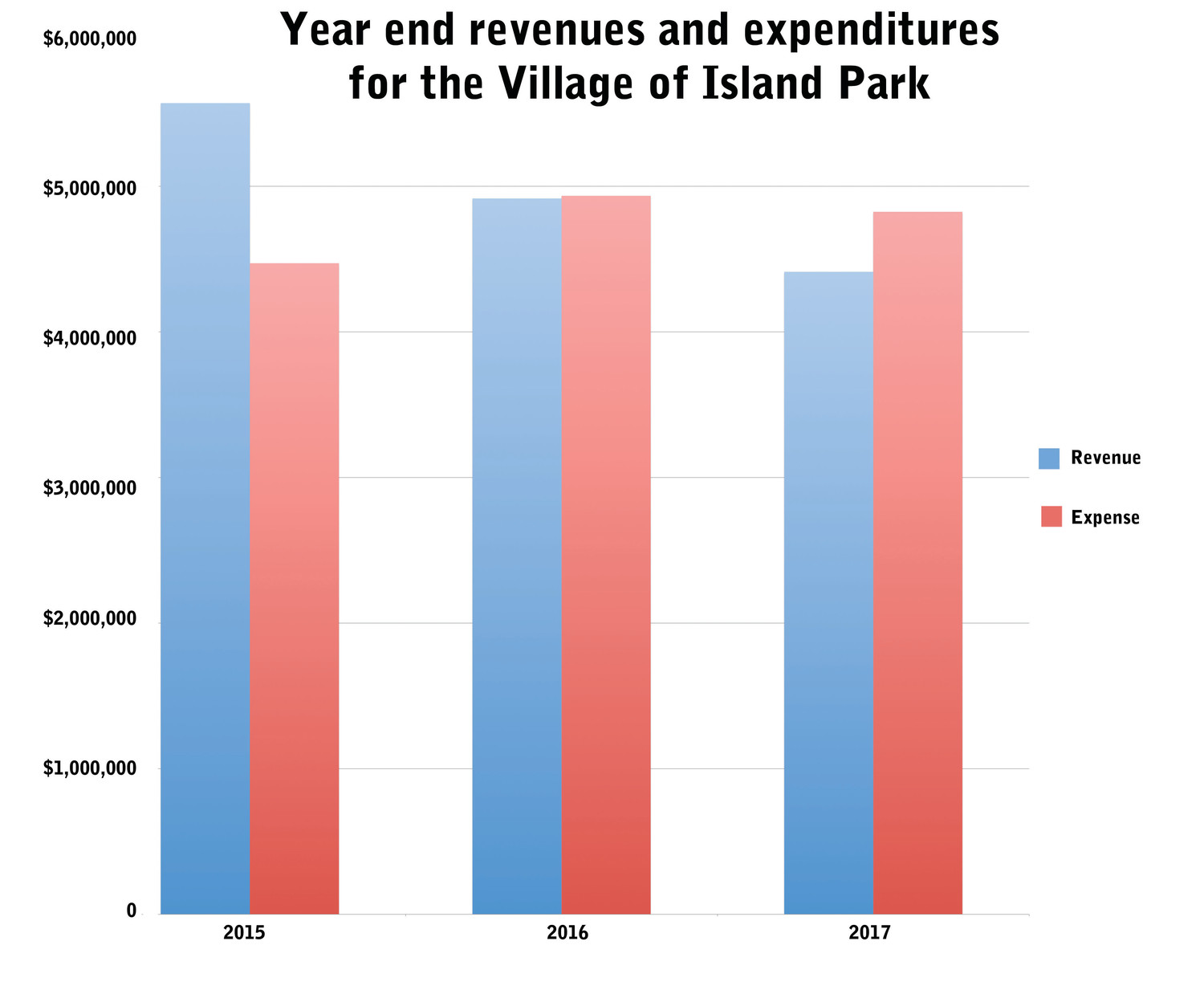

In the review, Island Park’s general fund balance for the 2017 fiscal year was roughly $447,000, with gross expenditures equaling $4.8 million outstripping its gross revenue of $4.4 million. Additionally, the village was penalized in the review for its issuance of a $500,000 four-year bond anticipation note, which McGinty said would bear an interest rate of around one percent, and was used to pay for the replacement of various Department of Public Works equipment.

McGinty explained that his government had already received a payment of $133,000 from the Federal Emergency Management Agency for post-Sandy repairs not included in the report, and that the remainder of the balance would be covered by additional reimbursements from FEMA, the State Dormitory Authority and Nassau County.

“We will continue with spending cuts,” he added. “And we will continue to keep at or below the governors tax cap.”

Butry admitted that although extenuating circumstances could affect the village’s score, he advised better long-term planning to help avoid situations that push its finances to the “significant” stress level. He added that the designation would not affect Island Park’s bond rating.

“Our biggest recommendation is to have multi-year financial plans in place,” Butry advised. “And to look at trends on revenue and expenditures in order to make better decisions down the road.”

Anthony Rifilato contributed to this story.

44.0°,

Mostly Cloudy

44.0°,

Mostly Cloudy