Long Beach man arrested for tax fraud

Baldwin accountant allegedly stole from client

A Baldwin tax preparer was arrested on felony grand larceny and fraud charges last week, after he allegedly cashed his client’s sales tax return checks and deposited them directly into his own corporate account.

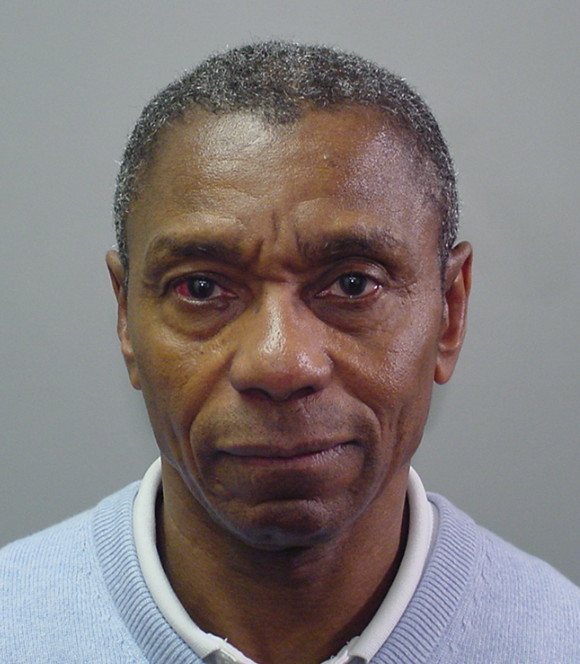

Acting Nassau County DA Madeline Singas said that 63-year-old Long Beach resident James Lee, a licensed CPA, was charged with two counts of second-degree grand larceny, one count scheme to defraud and three counts of offering a false instrument for filing.

Lee was arraigned on Feb. 3 by Nassau District Court Judge David McAndrews.

“Taxpayers should be confident that those assisting them with their taxes are professional, honest and trustworthy,” Singas said in a news release. “Any tax preparer who makes false statements, submits false information or steals the tax refunds of others should know that my office will vigorously prosecute. We will continue to protect taxpayers, as well as vital public services funded by tax revenue.”

Lee’s bail was set at $25,000 bond or $12,500 cash. If convicted he faces a maximum sentence of five to 15 years in prison. He was scheduled to appear in court on Feb. 5.

According to Singas, since 2007, Lee had served as the accountant for a client owning three restaurants, handling all of the business-related taxes for the restaurants including tax filing and tax payments. In 2013, the Internal Revenue Service and New York State Department of Tax and Finance contacted Lee’s client regarding underreported sales and the underpayment of taxes, officials say.

According to a police report, a new accountant was brought in to go over the client’s books. It was discovered that Lee had allegedly been cashing his client’s sales tax return checks and depositing them directly into his own corporate account.

The returns Lee had been filing with the NYSDTF were actually tens of thousands of dollars less than the amounts indicated on the copies of the returns Lee had given to his client, Singas said in a news release.

The client confronted Lee about the stolen and underreported funds. He provided his client with a series of bad checks that bounced, officials say. The new accountant alerted the DA’s Criminal Complaint Unit in September 2014 of the misconduct. A joint investigation was launched and conducted by the district attorney’s office and NYSDTF.

Neither Lee’s client nor the NYSDTF have yet to receive any portion of the missing funds, estimated at $117,131, prosecutors said.

Assistant District Attorney April Montgomery of Acting DA Singas’ Economic Crimes Bureau is prosecuting the case against Lee, who was represented by Justin Feinman, Esq. at arraignment. Singas’s office warns taxpayers who suspect that they may have been similarly victimized to contact the Economic Crimes Bureau at (516) 571-2149.

47.0°,

Mostly Cloudy

47.0°,

Mostly Cloudy