Bellmore-Merrick dealing with new LIPA payment plan

Bellmore-Merrick homeowners could see their property-tax bills rise or services reduced in the future to make up for lost taxes that were, until recently, paid for by the Long Island Power Authority, and before that by the Long Island Lighting Company.

When LILCO’s Shoreham Nuclear Power Plant was closed in the mid-1980s, talks began to do away with the lighting company and replace it with a public authority. Shoreham was fully decommissioned in 1994, and the Long Island Power Authority was born in 1998. Fifteen years later, the Public Service Enterprise Group, PSE&G, a private entity, took over LIPA’s daily operations, managing its electric system.

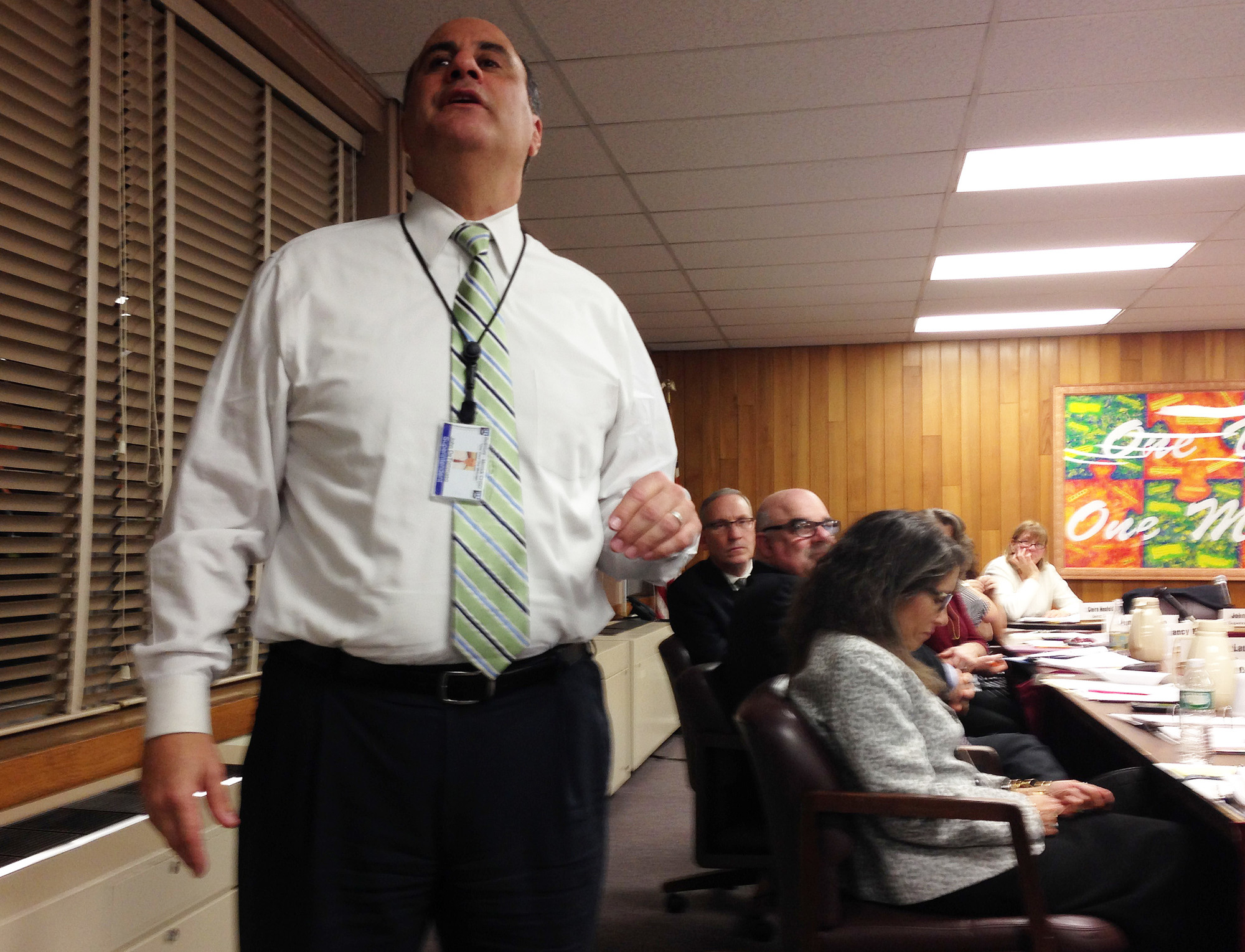

LILCO paid taxes on properties that it owned. When LIPA took over, the utility’s properties were supposed to have been taken off Nassau County’s tax rolls, and LIPA was supposed to have made payments in lieu of taxes, or PILOTS, on them, according to Cynthia Strait-Regal, the Bellmore-Merrick Central District’s deputy superintendent for business.

LIPA’s properties, however, were never removed from the rolls, and the authority continued to make tax payments, Strait-Regal said. “They were getting tax bills, and they were making payments,” she said.

After LIPA was restructured in 2014, it was decided that the utility would make PILOTs. The county took LIPA’s properties off the tax rolls last year.

It was further decided, Strait-Regal said, that PILOTS could not exceed 2 percent, in line with New York state’s tax-levy cap. “They put their own cap on” the PILOTs, she said.

The problem is this, according to Strait-Regal: Although a district might keep its annual tax-levy hike within 2 percent, or the cost of living (whichever is less), property taxes might go up more than that figure. The reason: Each district is allowed certain exemptions. Property-tax increases that result from districts’ capital projects, for example, are exempt from the cap.