S&P raises Oyster Bay out of junk status

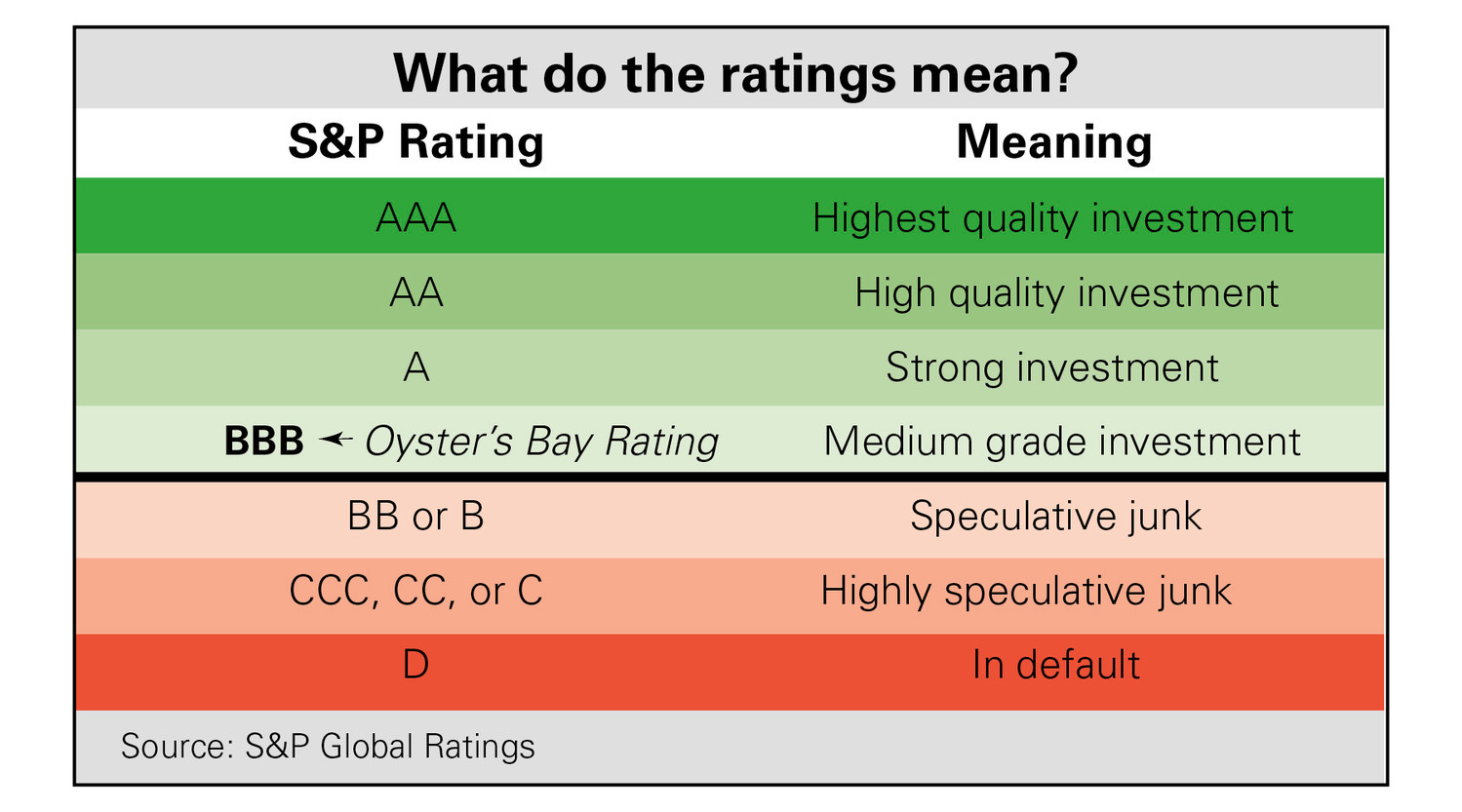

After being saddled for almost two years with a junk bond credit rating stemming from a decade of consistent budget deficits, the Town of Oyster Bay has been upgraded to a stable investment rating by Standard & Poor’s.

A report issued by S&P on March 16 stated that the upgrade was based on a combination of cost-cutting measures, including union salary rollbacks, and revenue-enhancing measures, such as a 11.5 percent increase in the 2017 tax levy passed by then-Supervisor John Venditto, under whom the town had accumulated $792 million in debt.

Venditto resigned from his 20-year-long tenure as supervisor in January 2017 following his arrest on corruption charges.

Current supervisor Joseph Saladino celebrated the upgrade. “We are being recognized by Wall Street after independent reviews, and this great news clearly proves the bold steps we have taken to fix Oyster Bay’s finances,” he said in a statement. “My administration put a stop to the past practice of endlessly borrowing against the future, and paid off $84 million in 2017.”

Not everyone hailed the upgrade, however. “When I think about it,” said Bob Freier, who in 2017 unsuccessfully ran for town board, “what is he bragging about? We are barely investment grade.” Freier also noted that several of the measures that S&P said contributed to the upgrade were instituted under Venditto, adding, “Joe Saladino is taking credit for something he had nothing to do with.”

One of the factors the report cited was the town’s newfound proclivity for accurately predicting revenues and expenses, and for avoiding basing decisions on optimistic assumptions about the bottom line.

In the wake of the upgrade, the town board voted on March 27 to begin a number of bonding processes. The total number was unclear from the meeting’s agenda, or from the discussion at the meeting. Saladino characterized the proposed debt as “rather small” compared with the $75 million average annual debt the town had historically taken on.

The bonds would pay for a series of capital projects, including the purchase of 12 sanitation vehicles to assist in the town’s recycling efforts; improvements to public parks and playgrounds; $6.8 million for parking garage improvements; and potentially another $5 million for repaving of roads that Saladino said at the boad meeting have been a focus of residents’ anger.

“Speaker after speaker who come out to our board meeting,” Saladino said, “one item is crystal clear. The public has asked for the roads to be repaved.”

Still, some residents said they were not comfortable with the town’s taking on more debt so soon after a credit upgrade. James Versocki, a Sea Cliff resident who has run for town council, said, “They seem to think we’re out of the woods, but we’re only one level above junk bond status.” He added, “It’s just crazy to me” that the board would consider bonding “literally within a week of a minor upgrade. The ratings agencies are not going to look very favorably on this.”

Saladino said, “Even with this bonding . . . we will still pay off $50 million, net, in an effort to continue to move toward reducing the debt of this town.” He also noted that between 2017 and 2018, the town was on track to pay down more than 22 percent of its total debt.