Comptroller: N. Bellmore should have crafted tighter budgets

North Bellmore School District officials have responded to an audit report issued by New York State Comptroller Thomas DiNapoli on July 2 that suggests former administrators overestimated expenditures in past budgets.

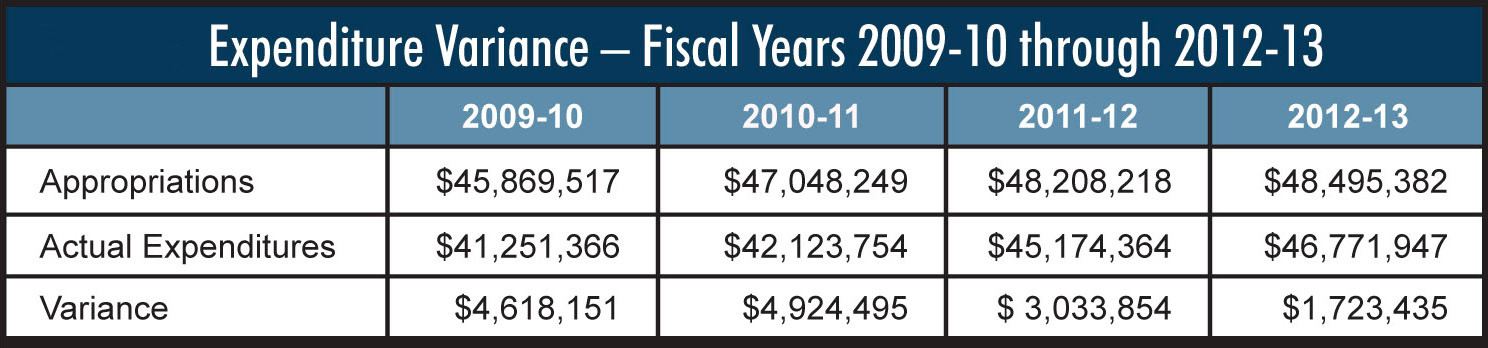

The North Bellmore School District, which takes in students from North Bellmore and part of North Merrick, is audited by the comptroller every five years. The 2012-13 audit report states that, from 2009-10 through 2012-13, the district overestimated appropriations by $14.3 million, which would suggest that officials budgeted more money than they needed to fund operations. But Mark Schissler, the current assistant superintendent for business, said residents shouldn’t jump to the conclusion that they were overtaxed during those four years.

The auditors said that officials did not use results from prior years to guide them in preparing their budgets, resulting in what they said were larger-than-necessary differences in the amount of money budgeted and the amount of money spent. The district’s total revenue exceeded expenses by more than $4.7 million from 2009 through 2013, examiners reported.

Schissler explained that officials used extra funds from a given year as revenue the next year to prevent spikes in the tax levy –– the total amount that the district must raise in property taxes to meet expenses.

Pointing out a table in the audit report (see chart), Schissler said there was a large difference in the appropriations and actual expenditures for the 2009-10 and 2010-11 fiscal years –– $4.6 million and $4.9 million, respectively. He noted, however, that those amounts decreased to about $3 million in 2011-12 and $1.7 million in 2012-13.

Schissler said the unexpended funds were used as a type of savings called a fund balance. Fund balance represents both unused money and any extra revenue that the district brings in during a given year. The total can be applied as revenue in the following year’s budget.

“If they didn’t have this money at the end of that year, the following year they would have had to raise the taxes more,” he said. “As long as the district gives that fund balance back as a revenue, they’re using it. So you can’t say that every year the district overtaxed.”

44.0°,

Mostly Cloudy

44.0°,

Mostly Cloudy