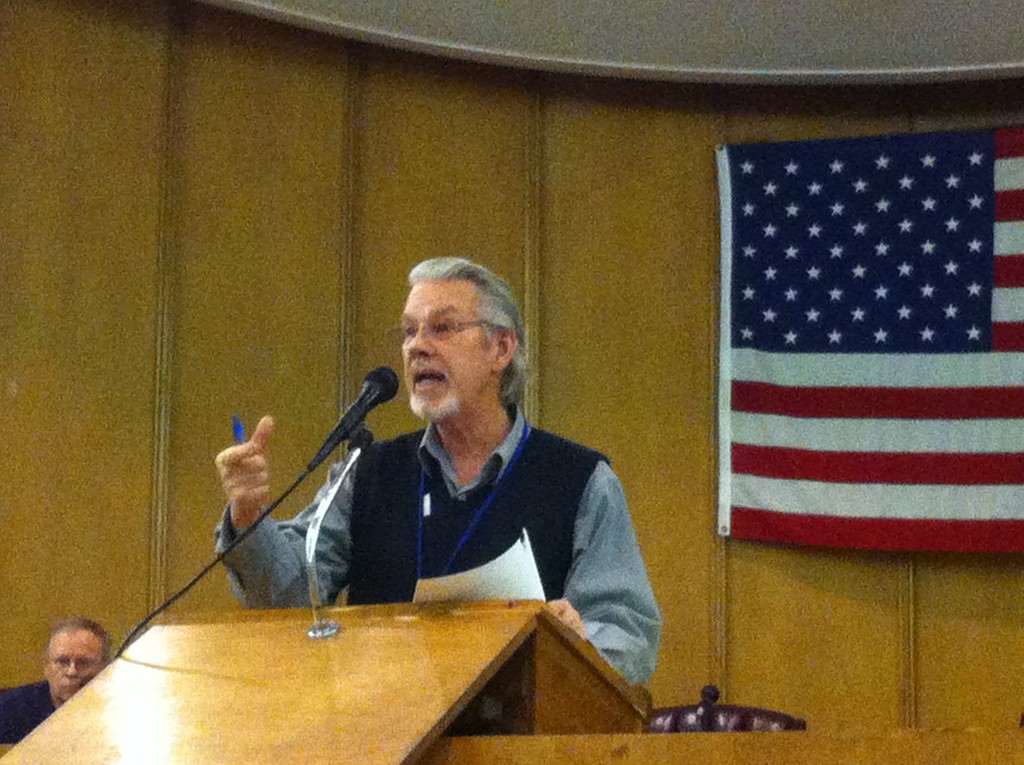

FEMA meeting gets heated

Residents press agency for answers

“Our dock came crashing through our living room wall,” said a woman from the Canals who came to the city’s public housing forum on Feb. 13. “The bricks tumbled all over the place. There’s a 12-foot hole in the side of the house. That somehow did not end up on the report from the insurance company.”

In the months since Hurricane Sandy ripped through Long Beach, residents have been struggling to repair their homes and restart their lives. Many have complained about wildly incorrect insurance assessments, weeks of unreturned phone calls from insurance companies and conflicting information from different agencies.

The city and the Federal Emergency Management Agency hosted the forum at City Hall to give residents a chance to direct their questions about housing and storm recovery to representatives of the agencies they have been struggling with — FEMA, the National Flood Insurance Program and the U.S. Small Business Administration.

“The city wants to get you answers,” said Long Beach Building Commissioner Scott Kemins. “The only way to get answers is to get everyone in the same room at the same time.”

But many attendees complained afterward that the forum was useless, that the representatives didn’t have the information they needed and that they left with more questions than they came with.

When a woman asked if there was any way FEMA could extend its rental assistance program past the 18-month limit, she was told that the decision wasn’t FEMA’s to make, and that Congress would have to pass legislation to change the rule.

When a man asked why, when it comes to recoverable depreciation, his house is assessed differently by FEMA and NFIP because it is a two-family dwelling, he was told by a panel member, “Well that’s the rule.”

“You have to give me a little bit better answer than that,” the man said. “Why am I considered a second-class citizen? This is why we’re all here, to get some answers.”

44.0°,

Mostly Cloudy

44.0°,

Mostly Cloudy