Lynbrook merchants address concerns over school district's bond proposal

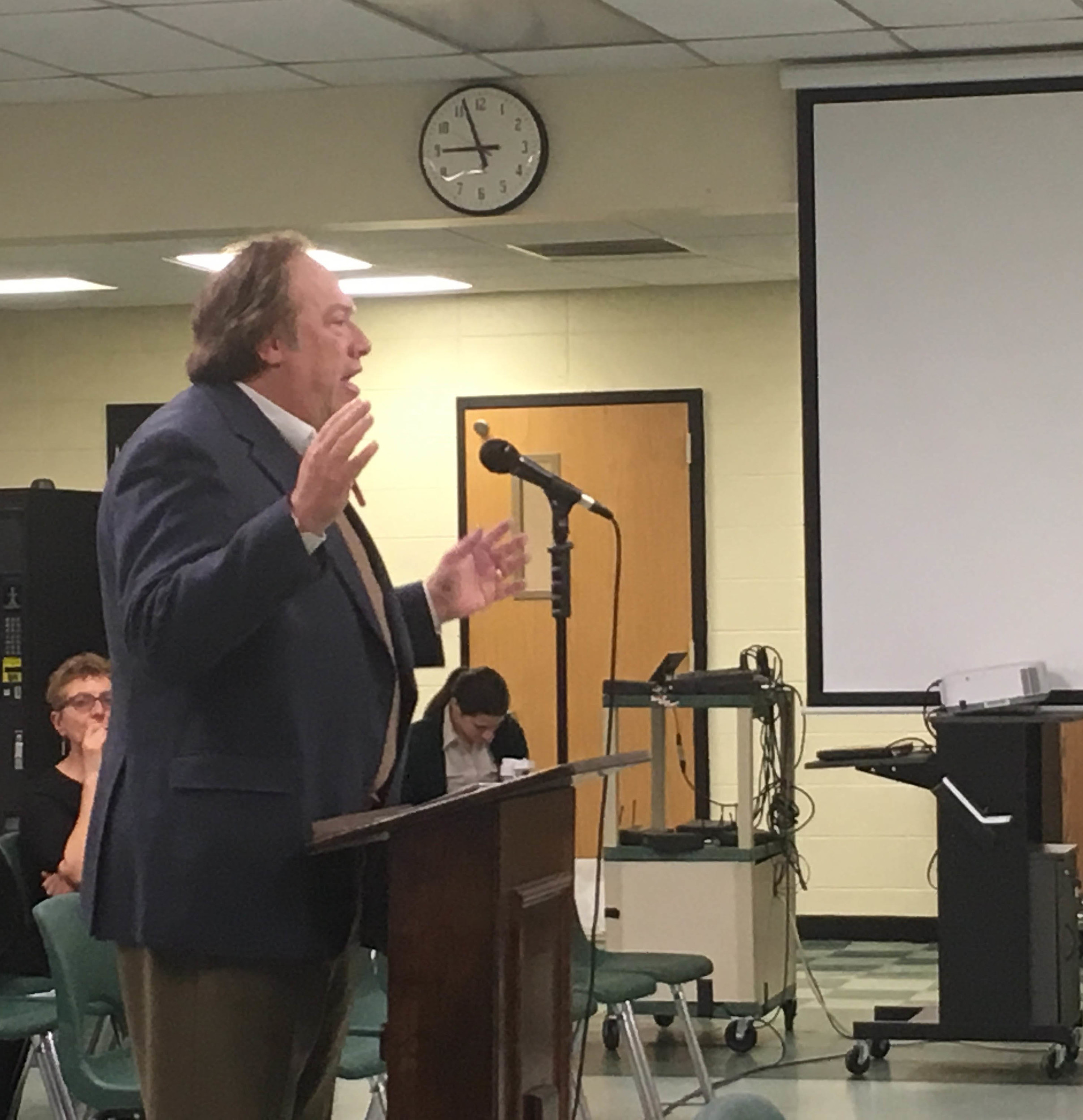

Jeffrey Greenfield, a managing partner of the insurance company NGL Group LLC, held up a Lipton tea bag at the Lynbrook School District's Board of Education meeting on Feb. 8. “I’m a victim of taxation without representation,” he said.

Greenfield said that when he received his property tax bill several weeks ago for his business at 112 Merrick Road in Lynbrook, he noticed that school taxes had increased by about 12.6 percent. “When I bought my 10,000-square-foot building 25 years ago, I had a total tax bill of $16,000,” said Greenfield, whose business recently celebrated 50 years in Lynbrook. “Right now I’m going to push $100,000. That’s a lot.”

The board proposed a $28.9 million bond at its January meeting to make improvements to many of the district’s buildings, including Lynbrook High School. Residents voted down a $46 million bond last March, with a survey later revealing that many found it too expensive.

The newly proposed bond could make businesses pay even more in school taxes due to New York’s 2 percent property tax cap. Greenfield said he believes that small businesses are forced to make up the difference.

“I get the sticker shock because I actually look at this stuff, and I don’t know if, when you set the tax rate, you’re aware of this, but Lynbrook ranks right up on the top for the commercial taxpayer,” he told the board. The new costs associated with the bond would impact the tenants of the businesses, some of whom struggle with running costs, he added.

Greenfield was not alone in expressing concern. Harold Reese Jr., the president of Harrontine Realty Corp., also addressed the board. “Of course with any increase in taxes, these tenants are going to have to pay the increase,” Reese said, “and it’s very tough on a small scale to make payroll, to pay employees, the health insurance and all the rest of it.” Reese’s corporation owns Audi Lynbrook and the Il Luogo Restaurant, both on Sunrise Highway.

Melissa Burak, the superintendent of Lynbrook Public Schools, responded by saying that she understands the frustrations of the business owners.

According to Paul Lynch, the assistant superintendent for finance, operations and information systems, the Nassau County assessor, not the school district, decides what percentage of the total tax levy should be borne by residential and commercial property owners.

“We keep the tax levy below 2 percent, but the homeowner doesn’t see that because their tax bill goes up 7 percent,” Lynch said.

“We’re told we have a successful 2 percent tax cap. Well, not in Nassau County,” Burak said. “Because the assessment system is so lousy, and this is why they advertise everybody grieve, everybody grieve.”

Still, Burak said she believes that a bond is necessary to make renovations to the schools because the district cannot raise taxes above 2 percent. “Districts try to do their best to balance the budget in a tax-cap world,” she said. If approved by voters, the bond would pay for several upgrades to district facilities, including new rooms for chorus and band, and improvements on classrooms geared toward the STEAM curriculum, which focuses on science, technology, engineering, the arts and math.

Greenfield said he does not fault the school district for the high taxes. He added that he would like school board members to understand the effect of an increase on local businesses and to publicize that impact. “I ask you, I plead with you to think about the village commercial taxpayers — the business owners and the tax base there — and be cognizant of our position and our ability to pay the bills,” he said.

Updated on Feb. 22 at 11 a.m. An earlier version stated that businesses are not part of the tax cap, they are.

44.0°,

Mostly Cloudy

44.0°,

Mostly Cloudy