Brooks pushes school tax relief plan in North Bellmore

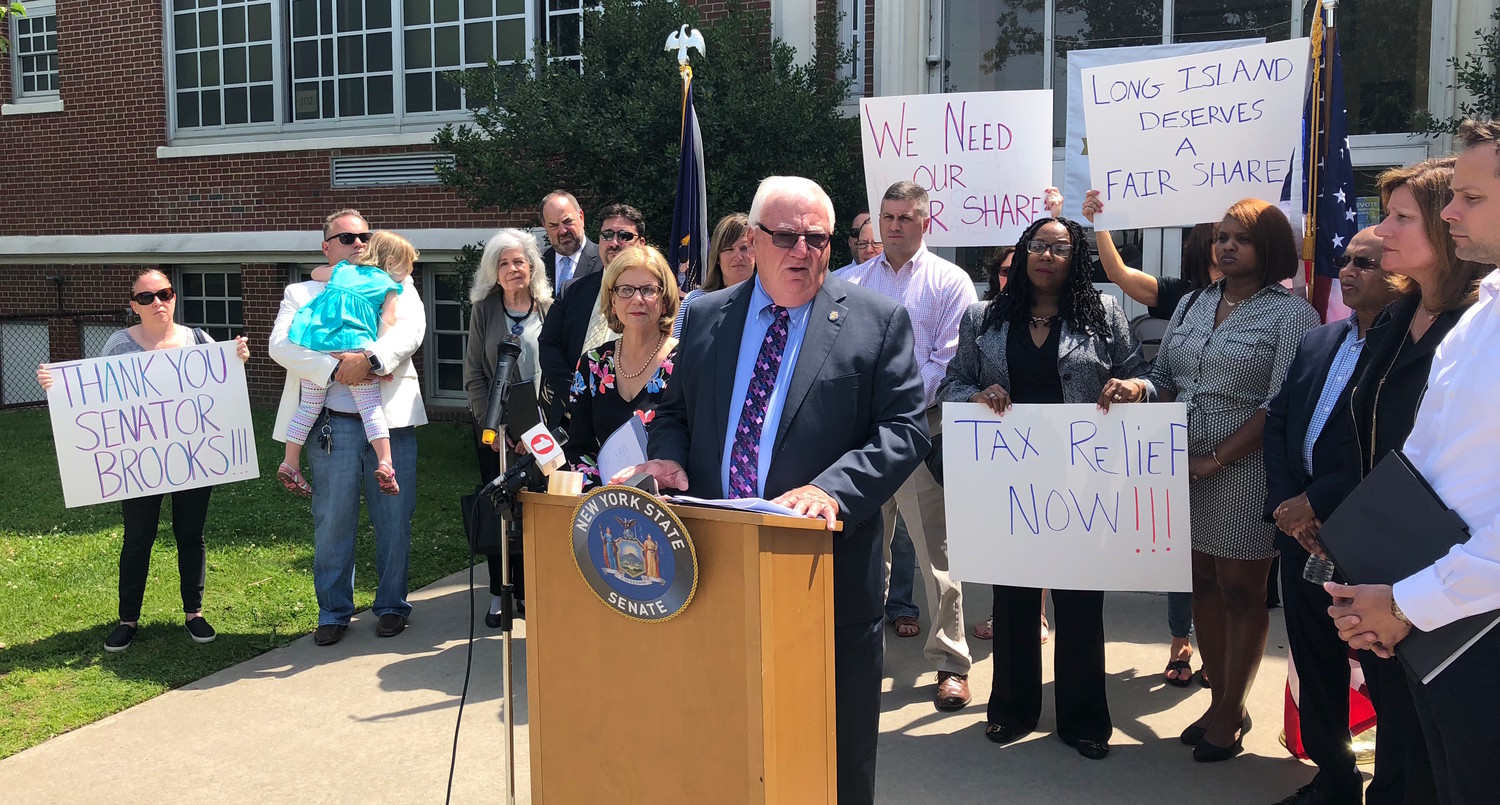

State Sen. John Brooks pushed on June 8 for a bill that would change the rules by which districts receive state aid, and, Brooks said, could bring property tax relief to Long Islanders.

Brooks’ decision to roll out his plan in North Bellmore was deliberate: The school district’s budget failed to pass last month because of voter-petitioned ballot measures that would have exceeded the state property-tax cap. The district lowered its budget by $75,000, and will hold a second vote on June 19.

Brooks’s plan would cap the residential property tax of New York counties at 50 percent of local taxes; the state would then make up any shortfall by funding the rest of a district’s budget with increased education aid. Roughly 70 percent of North Bellmore residents’ taxes go toward education, according to Brooks.

The 50 percent cap would mean $2 billion in relief statewide, and $1.3 billion in relief to Long Island, according to Brooks.

“The burden of funding education has fallen on the homeowner,” Brooks said in front of Newbridge Road Elementary School. “For too long, Long Island families and residents have been crushed by high property taxes. There is limited state aid as it is, and we aim to fix that.”

“North Bellmore pays 70 percent of the educational tax, while other districts pay far less,” said North Bellmore School District Superintendent Marie Testa, who was there to support the legislation. “There is an unfair penalty for the geographical location of a resident’s home. It goes off of an antiquated financial aid formula. Our residents cannot continue to bear this burden.”

In 2016, the total property-tax levy for Nassau County was $4.3 billion, with residential property taxes accounting for $3.2 billion, or 75 percent, of the total.

Relief, such as what Brooks said his bill would provide, is especially needed since the new federal tax law passed this year by congressional Republicans caps state and local tax deductions at $10,000, according to Brooks.

“The rules were changed,” said State Sen. Shelley Mayer, a Yonkers Democrat, who also attended the briefing. “Residents were lied to and double-crossed by the Trump tax bill, leading to a loss of millions of dollars to our communities, and thousands of dollars to them personally.”

Testa added that property tax bills are based on the current assessed values of residents’ homes, not their income or ability to pay the taxes. While residents may live in million-dollar homes, their income may not reflect that.

“It makes Bellmore look wealthy,” she said. “It creates pockets of wealth and ‘invisible homes,’ or homes that are worth more than taxpayers have. Sen. Brooks’s bill is the answer to a problem that has plagued Long Island for far too long.”

“I have two daughters that go to school in Bellmore. I moved to North Merrick so I could raise a family here,” North Merrick resident John Plock said. “Long Island pays some of the highest property taxes in the country, and now the federal tax plan is going to destroy our suburban way of life. I just don’t know that I can afford to raise my family here.”

The plan would have a three-year limit, bringing tax relief until 2021. Brooks said he hopes that if the plan were to pass, it would show meaningful relief for taxpayers, leading to a reauthorization. His main concern, however, is bringing immediate relief to reduce any higher taxes that might occur.

Brooks’ plan is under review in committee, and he said he hopes communities make enough noise to get it passed. However, without Republican co-sponsors or support, the bill will likely face an uphill climb.

“People should speak up about being crushed by the current [federal] tax plan,” he said. “They need tax relief, and now the proposal is on the table.”

Erik Hawkins contributed to this story.

49.0°,

Fair

49.0°,

Fair