‘Questionable’ veterans’ exemptions burden taxpayers

Recommendations from two-year-old audit have not been met

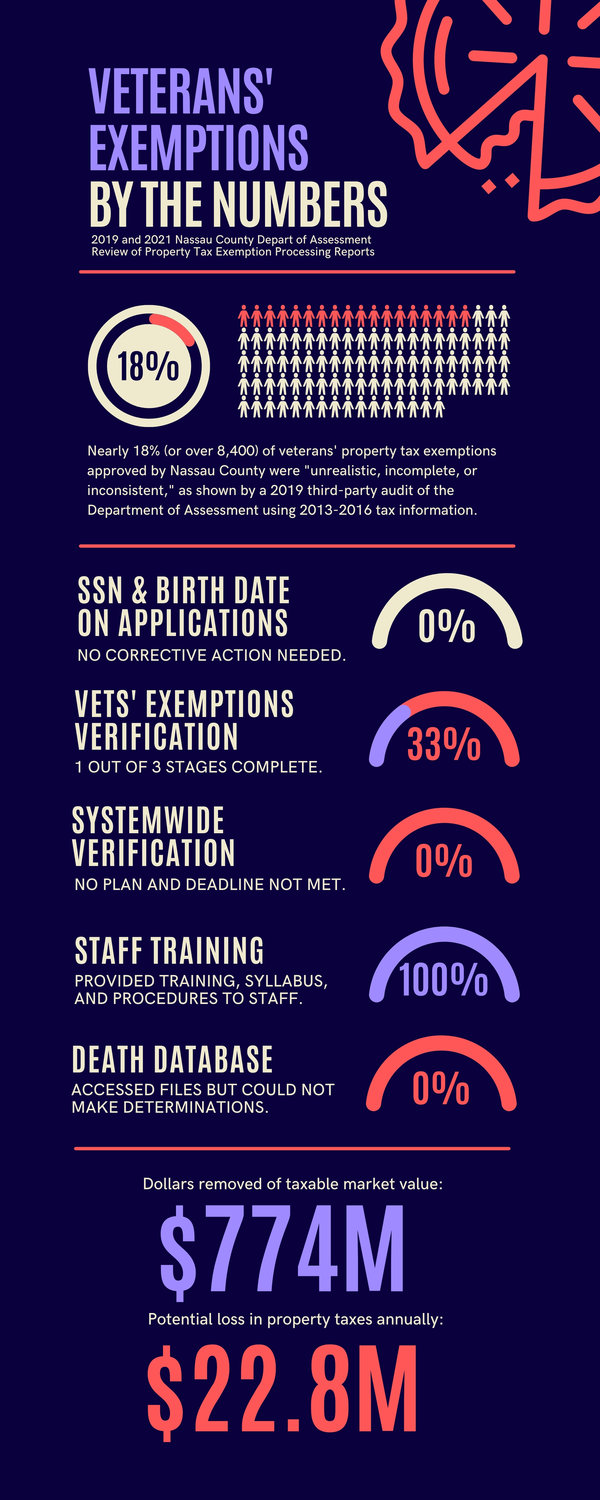

Nassau County taxpayers may still be footing an annual $22.8 million bill for ineligible residents claiming veterans’ property-tax exemptions, after the county Department of Assessment did not fully implement recommended measures that would remove exemptions that no longer qualify, according to a May 21 follow-up audit report.

In 2019, a third-party audit found that from 2013 to 2018, more than 8,400 of the county’s veterans’ property tax exemption applications — or 18 percent of the total — were incorrect under the previous comptroller George Maragos, with “military service dates that were unrealistic, incomplete or inconsistent,” resulting in the removal of $774 million in taxable market value.

The auditors recommended that the county update collected information, add fields to new applications, train staff, periodically assess death files and verify all — not just veterans’—exemptions not requiring annual recertification. Two years later, County Comptroller Jack Schnirman reports that “measurable progress” has been made, but the follow-up audit shows that the recommendations, except one, have not been fully implemented.

Veterans’ exemption laws usually require the owner of a primary residence to be a veteran, a surviving un-remarried spouse or in some cases a surviving family member in order to receive an exemption that ranges from 5 to 15 percent of the property assessment, barring some exceptions, according to Nassau County.

The 2019 audit found that lack of quality control stems from placing the responsibility on the taxpayer to report disqualifying events that would remove the exemption, which by law does not require annual recertification. Under the current controls, if a veteran or dependent moves or dies and the home is then occupied by ineligible parties, the parcel could continue to receive exemptions for years.

Among the findings of the 2019 review, the auditors identified 8,289 exemption applications that had no military service dates listed; 101 showed that service began prior to 1929, which would make the veterans 101 to 133 years old; and 20 said service started in 2020, which would be impossible for an exemption filed in 2016.

The 2021 follow-up report also addressed other property assessment issues besides the veterans’ exemptions, such as the ADAPT system, personally owned clergy property and leadership accountability. Out of a total of 31 recommendations, 15 were implemented, 14 were in progress, and two were not implemented.

The Department of Assessment agreed to verify all existing veterans’ exemption files in three stages, starting on May 1 and ending on Sept. 30 last year. The department mailed letters requesting supporting materials to the 8,289 applicants noted in the audit, and received 5,887 responses. Officials were then able to remove 100 exemptions. There has been no update since Aug. 6, however.

Additionally, the department accessed death files to remove exemptions for deceased applicants on Jan. 14, 2020, but these files did not provide enough information to make any determinations.

Even though department officials said they were reviewing veterans’ exemption files, they did not address a system-wide verification process for all exemptions not requiring annual recertification. The target date for implementing such a comprehensive system of Sept. 30, 2020, was not met.

The auditors reiterated the importance of such system-wide verification, as it affects other troublesome exemptions and would address the problem at its root.

The department did implement a request for staff training on exemption application processing. Officials provided special training to employees in 2019, a syllabus on the subject to all new staff and existing personnel, and operating procedures to auditors.

Finally, the comptroller’s office found that the department did not have to request Social Security numbers and birth dates for future veterans’ exemption applications, as they do not have authority over these state forms.

Some county residents are confused as to how veterans’ exemptions work. Baldwin resident Zoe Tague asked, “Don’t they have to show proof of service?”

Meanwhile, other residents are concerned the county has not fixed the problem, including Maggie Conaty Eberhart, who said it’s “ridiculous if the county is not on top of it.”

44.0°,

Mostly Cloudy

44.0°,

Mostly Cloudy