The refund checks are in the mail

County: $21.4M in refunds on the way to hurricane damaged homes

Nassau County Comptroller George Maragos announced that 6,700 refund checks will be mailed, beginning late December through early January, to compensate homeowners whose tax assessments were not adjusted lower for tax years 2012/13 and 2013/14 to reflect the damage from Superstorm Sandy.

The average refund is $3,100, with five percent receiving amounts greater than $5,000. There are approximately an additional 2000 applicants whose claims require further determination by the County assessor. These refund checks may take somewhat longer and represent an additional $8 to $9 million in possible refunds.

“I am happy that Superstorm Sandy affected homeowners and businesses are finally getting relief for the damages they suffered,” said Maragos. “I apologize if the payments took longer than originally expected, but we had to verify every claim and ensure that our residents received the maximum reimbursements allowed by law.”

County Executive Mangano announced the Sandy relief initiative on Oct. 30, 2013, under the “Superstorm Sandy Assessment Relief Act” Nassau County adjusted, retroactively, any property tax assessment to account for losses in value due to Superstorm Sandy. The County bonded $35 million to pay for the anticipated Sandy property tax over-assessments with the commitment from Governor Cuomo that the County would be repaid by New York State.

“My administration helped develop this program so that homeowners and employers impacted by Superstorm Sandy would receive relief for the damages they suffered,” said Mangano. “While some taxpayers received a credit on their tax bills already, I’m happy to learn that checks are now on the way to those who haven’t yet received this important tax relief.”

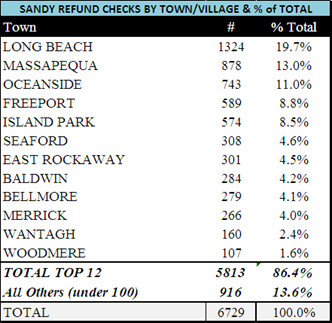

The table below shows the top 12 municipalities which will receive 90 percent of the refund checks. Long Beach will receive 1,324 refund checks, the most, followed by Massapequa with 878 refunds.

75.0°,

Partly Cloudy and Breezy

75.0°,

Partly Cloudy and Breezy