Elmont budget exceeds 2 percent cap

District has one of 3 school spending plans in Nassau County to require supermajority

Compared with most New York state school districts, the Elmont Union Free district’s spending plan for 2012-13, unveiled by the Board of Education on April 17, represents higher stakes for the community’s schools. The district is one of only three in Nassau County — along with Floral Park-Bellerose and Island Park — to exceed its allowable tax levy increase for next year’s budget.

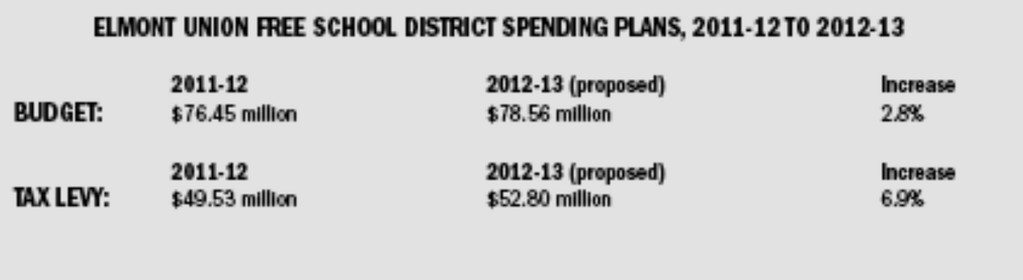

Elmont’s proposed spending plan of $78.56 million, a 2.8 percent increase over the current budget, includes a tax levy increase of 6.9 percent — 5 percentage points higher than its allowable increase of 1.89 percent under the property-tax-levy-cap legislation enacted by Governor Cuomo and the State Legislature last June. As a result, it will require approval by a supermajority of voters — at least 60 percent — on May 15 to pass.

School districts have struggled in recent months to make ends meet in their upcoming budgets due to the mandated cap, which limits the increase in property taxes that school districts can collect to meet expenses and, as a result, limits their ability to add programming to improve student performance.

According to data released last week by the state’s Department of Education, nearly 92 percent of school districts in the state, or 618 of 669 districts, plan to abide by the cap, which for most districts is around 2 percent, but varies according to a formula provided by the state. The average tax levy increase statewide is 2.2 percent.

One of the factors that determines a district’s tax levy cap is the rate of inflation, and, unfortunately for Elmont, the school district’s rate of inflation for fiscal year 2011 was 1.89 percent, which reduced the district’s cap below 2 percent.

According to Superintendent Al Harper, $1.74 million, or 82 percent, of the budget increase is attributable to state mandates. Harper explained that retirement system expenses are expected to increase by 15 percent, or $771,309; health insurance expenses are expected to increase by 11 percent, or $518,480; and special education enrollment costs are expected to increase by $452,496.

“The mandates are really astronomical,” he said.

60.0°,

Mostly Cloudy

60.0°,

Mostly Cloudy