Lawrence proposes flat tax rate

Village budget hearing on April 3

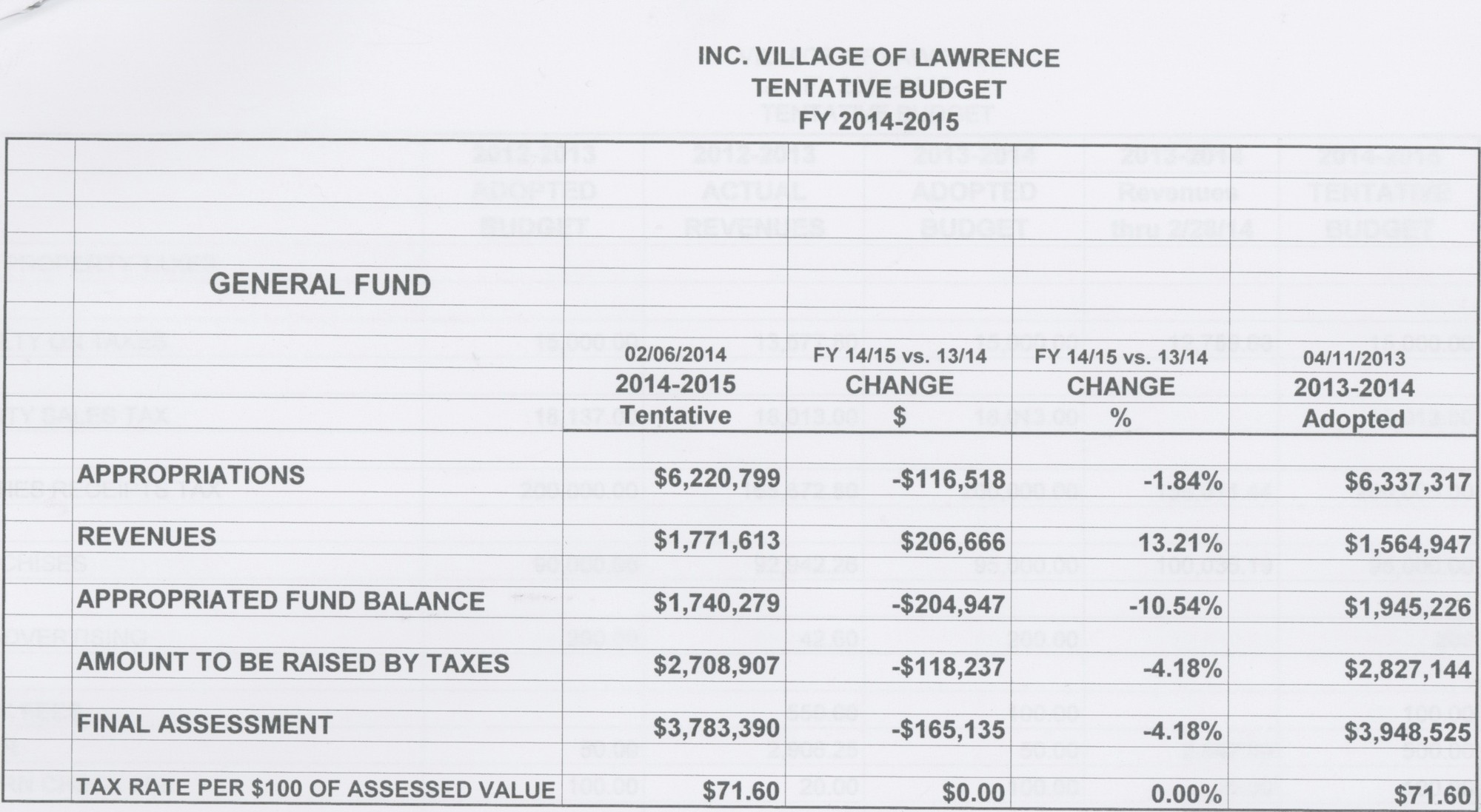

The preliminary Village of Lawrence budget of $6.220 million that will be discussed during a public hearing at the April 3 board meeting includes a proposed tax rate of $71.60 per $100 of assessed value; the same rate that has been approved for the past three years.

Though the tax rate is unchanged, Lawrence anticipates revenue to rise by $206,666 from the current expected amount of $1.564 million. “That is a function of budgeting and an increase in feels, including building fees,” said Mayor Martin Oliner. “The budget is in line with what we’ve done historically.”

Oliner said that the village is trying to maintain services while spending less money. Lawrence saved money this past winter by not having employees working at the village-owned and operated Lawrence Yacht & Country Club.

But as residents continue to grieve their property taxes and receive reductions from the county, the amount of tax dollars Lawrence received decreased for the third straight year. It is expected to be reduced by $118,237 from $2.827 million. To make up for the lost revenue, the village plans to use $1.740 million from its reserves.

As for other municipalities, employee benefits are the most expensive costs for Lawrence. But a savings of more than $50,000 could be realized in retirement payments as the village has budgeted $350,000 for that in the tentative budget compared to $406,648 in the current fiscal plan based on smaller workforce. More than $120,000 could be saved as $650,000 was budgeted for medical insurance compared to $773,800 in the present

Though there could future savings, previous years expenses at the club and employee pension and health care costs have sliced into the village’s once sizable reserve fund and Lawrence needs to address that, Trustee Michael Fragin said.

“This trend will undoubtedly lead to a reckoning with a sizable tax increase next or the year after,” Fragin said. “The current trend cannot continue without significant adjustment to either revenues or expenses.”

Fragin declined to unveil any recommendations. “That’s what the budget hearing is for,” he said. Is it not?”

The meeting will be at Village Hall at 196 Central Ave. in Lawrence at 8 p.m.