Lawrence will not raise taxes

No residents attend hearing as village board adopts budget

Lawrence residents will not see an increase in their village property taxes for the new fiscal year beginning June 1. At a public hearing on Monday, the village board voted unanimously to maintain the current tax rate of $71.60 per $100 of assessed value, decrease the tax levy (the amount of money raised through taxes) and make up the difference by dipping into reserves. The board also adopted a $6.48 million budget for the 2012-13 fiscal year.

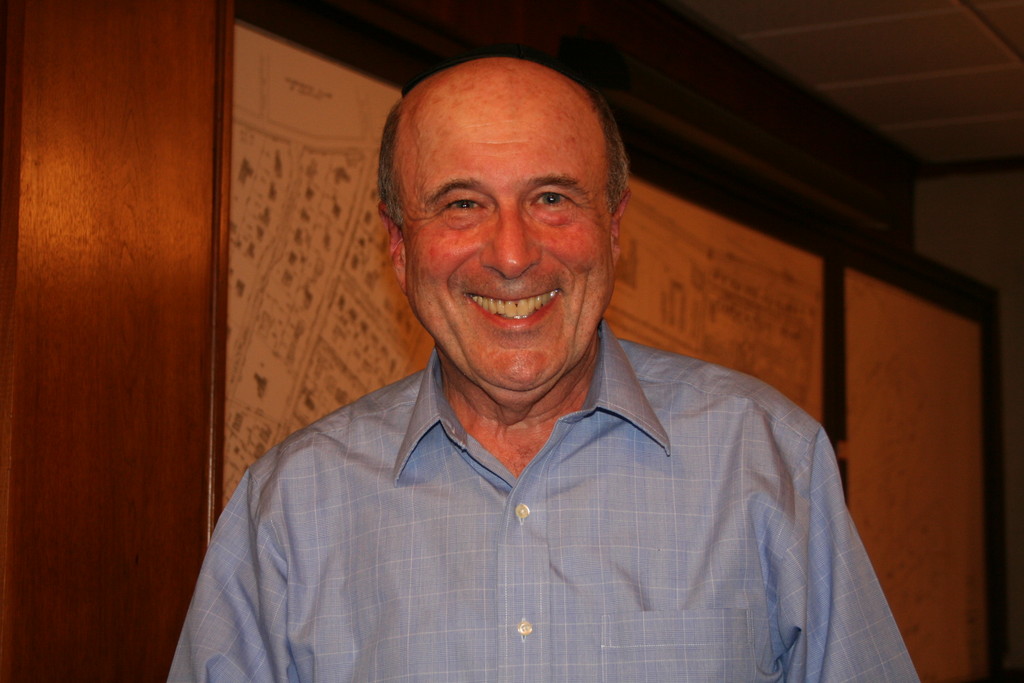

Mayor Martin Oliner initially wanted to cut taxes. He said he had wanted to do so last year as well, and that he still believes there is more than enough money in the fund balance — previously budgeted but unspent reserves. “We’ve taken too much money over a long period and there is no reason to hold it,” Oliner said. “A small tax cut is sensible.”

But the other trustees expressed doubts about cutting deeper into reserves to provide a tax cut. Ed Klar said he was concerned about cutting taxes at a time when the village has a $1 million deficit. He added that he would be even more concerned if the village goes ahead with loaning the Lawrence-Cedarhurst Fire Department $2 million to fund its two-story extension project.

“You may be more comfortable than I am,” Klar told Oliner, referring to dipping into the fund balance to support a tax cut.

Trustee Michael Fragin suggested setting a target number for how much to keep in the fund balance and how much to give back to taxpayers, if anything. “We need to propose a target of what is responsible to have [in the fund balance account], as we don’t have a lot of certainty about the future numbers,” Fragin said.

Trustee Joel Mael echoed Klar’s and Fragin’s concerns. “I would not be comfortable cutting the tax rate until the village’s budget is balanced,” Mael said. “When we have a balanced budget, then we can discuss what we’re comfortable with having [in the fund balance].”

To cut its tax levy — the money the village must raise through property taxes — the village will use $125,677 of the current fund balance of $1.7 million. It will collect $3.2 million in taxes during the 2012-13 fiscal year. The tax levy for the current fiscal year is $3.34 million.

The board also decided, at Klar’s urging, to reduce the anticipated revenue budget line from just under $1.66 million to just under $1.56 million. The higher number was predicated on interest revenue expected to be realized from the loan to the Fire Department. Since that loan may not be made, Klar suggested that the interest revenue be deleted from the budget, and it was. “I don’t know if it will be taking place,” he said of the loan, “and we shouldn’t budget something that doesn’t exist.”

Trustee C. Simon Felder was not at the meeting. Nor was even one other Lawrence resident, which irked Fragin. “Several members of the public come to [monthly village meetings] to talk about trivial issues,” he said. “And when we set taxes, no one comes. It’s disappointing, and the public should be more interested in the work that goes on here in the village.”

Oliner ultimately agreed to keep taxes where they are for now. “In a time when costs are increasing,” he said, “keeping the tax rate the same is as good as it’s going to get.”

62.0°,

Overcast

62.0°,

Overcast