‘Sticker shock’ as tax rates rise

School districts blame county assessments

The Lawrence and Hewlett-Woodmere school districts are part of the Nassau County chorus that is placing the blame of a higher tax rate on the county’s assessment system that is currently granting a substantial amount of tax reductions.

Residents in the Lawrence district approved a budget in May based on a 3 percent tax levy — the amount of money the district will collect from taxpayers — which is $82 million. The current budget is $93 million. Based on a reported figure, district residents will now have to pay at a 6.44 percent tax rate, the second highest in Nassau.

Superintendent Gary Schall said his district’s tax rate has increased due to the reductions in the amount of tax dollars the county is collecting, but it is not as high as portrayed. “Where that rate is coming from I don’t know, but our rate for 2013-’14 is 5.2 percent as per our auditors,” Schall said. “We are using the numbers homes and businesses and averaging it out per taxpayer unit, homeowner or a business for the total assessed value.”

Though the figure listed for Hewlett-Woodmere is 5.7 percent, Assistant Superintendent for Business Dr. Peter Weber said that the district will be collecting 3.45 percent more in taxes to supports is current $109.6 million fiscal plan. “The county assessment program is broken and our elected officials at the town and county level publicly invite taxpayers to appeal their assessment,” Weber said. “If everyone appealed … and everyone received the same percentage reduction, then the assessment will drop, the tax rate will rise to compensate.”

If the district choose not to increase the tax levy at all, and everyone received an equal reduction in assessed value, then the tax rate would rise and the tax bill would be remain unchanged, according to Weber.

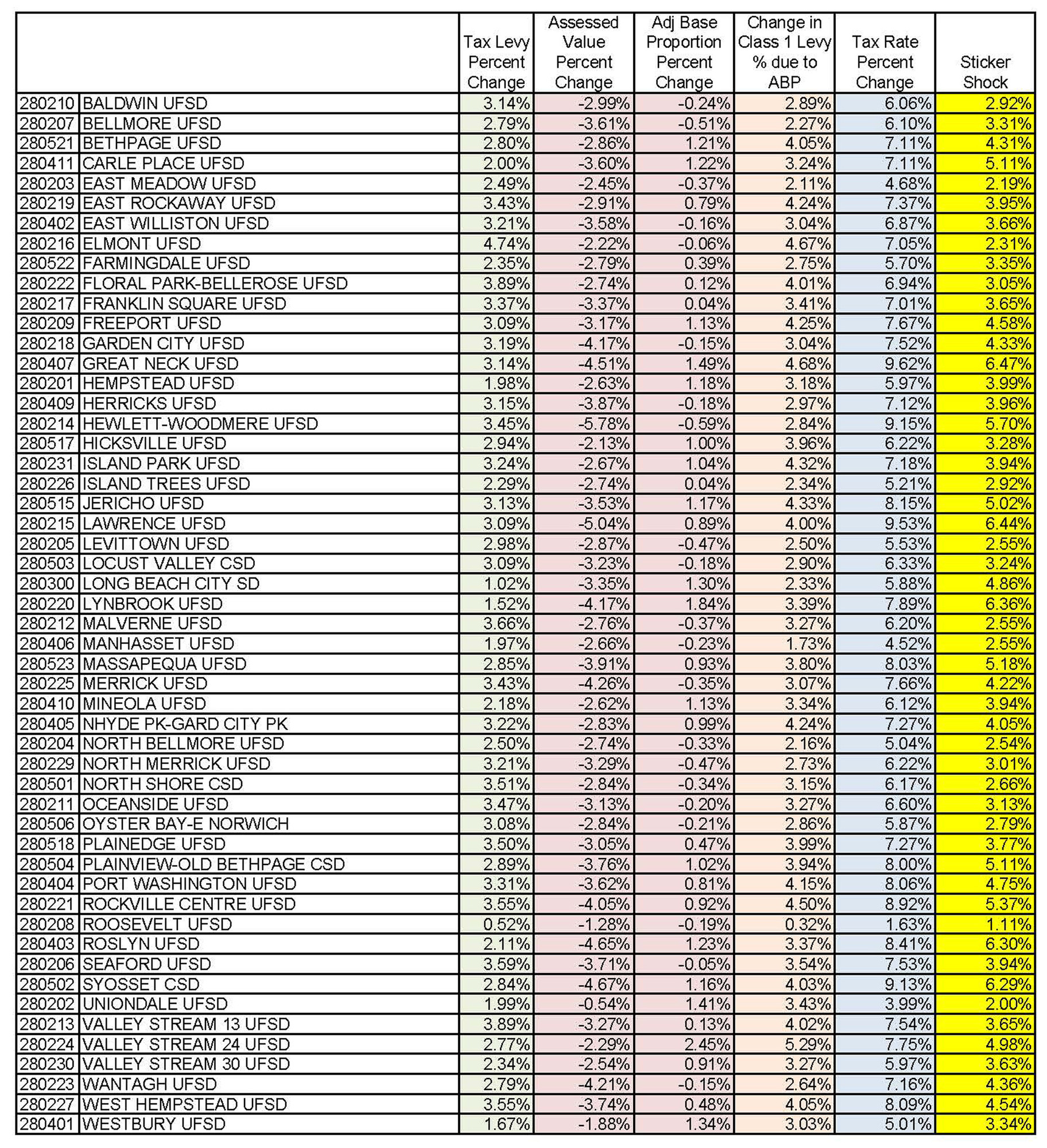

Joseph Dragone, assistant superintendent of business for Roslyn described the increase in tax rates as “sticker shock” for taxpayers and placed a chart of the numbers used by the county’s assessor’s office on the district’s website. Dragone used Lynbrook (6.36 percent tax rate) as an example.

“The county assessor decided to grant assessment reduction claims to 87 percent of the claimants county-wide and, in addition, decided that the homeowners of Lynbrook should carry a larger portion of the tax burden, “ he wrote. “The combined impact on the homeowner of the 4.17 percent reduction in assessed value and 1.84 percent increase in the portion of taxes to be paid means that the tax rate increase for homeowners in Lynbrook (7.89 percent) is literally five times as large as the tax levy increase (1.52 percent)!”

Schall said Lawrence is already looking at a $5.5 million increase in expenses, for next year, which could trigger another 3 percent tax levy. Those increases are once again coming from jumps in salaries and payment of health care and retirements benefits.

Increases are also possible in Hewlett-Woodmere, as spending jumped 3.61 percent or $3.819 million in the current budget from the 2012-’13 fiscal plan, also due to salaries and benefit payments.

Have an opinion about this topic? Send your letter to the editor to jbessen@liherald.com.

66.0°,

Shallow Fog

66.0°,

Shallow Fog