Tax-reform plans could harm Long Island

Senate version still in the works

The House of Representatives tax-reform bill was passed by a 227 to 205 vote on Nov. 16, paving the way for high-tax suburban regions like Long Island to be hit hard as the legislation would limit or eliminate deductions for property taxes, mortgage interest, and state and local taxes, while much of the rest of the country could see at least modest cuts in their federal tax bills, according to elected local leaders.

All 192 Democrats opposed the measure. That group included Congresswoman Kathleen Rice, who represents the Five Towns, and Rep. Gregory Meeks whose district includes Inwood, Valley Stream and Elmont.

“Rep. Rice voted no on the House Republican bill because it would raise taxes on many middle-class families in our district to pay for a huge tax cut for the wealthy and big corporations,” said Coleman Lamb, Rice’s communication director. “Half of our constituents deduct state and local taxes — this bill eliminates that deduction for individuals and families, but lets corporations keep it. It adds trillions to the deficit, which will lead to cuts to health care, education, Social Security and other programs that hardworking Americans depend on. Rep. Rice will keep working to defeat this bill and keep demanding real, bipartisan tax reform that puts the middle class first and provides relief to people who really need it.”

Meeks said that he voted against the measure because it in addition to raising taxes on the middle class, it would also eliminate the student loan interest deduction and lifetime learning credit and the medical expense deduction, “ransack” Medicaid and Medicare and “balloon the [nation’s] debt to the tune of trillions of dollars,” he said.

The congressman sought to add an amendment to eliminate tax break for private prisons, but prohibited from doing so. “Apparently, Republicans proceeded in irregular order because they so desired to increase our nation’s deficit by trillions of dollars, while making home ownership more expensive and increasing taxes on nearly 40 million middle-class Americans,” Meeks said.

Long Island Republicans Peter King, of Seaford, and Lee Zeldin, of Shirley, were among the 13 GOP members who voted against the House bill. Before the vote, King, who has supported President Trump on a number of fronts, said he would not support tax reform legislation that eliminated deductions for property taxes and state and local taxes, noting that the deductions have been in place since 1913.

“While I strongly believe our tax code needs to be reformed and simplified,” King said, “everything must be done to ensure property tax and state income tax deductions are preserved. No one should be taxed again on money you have already been taxed on at the state level.”

$1.7 trillion added to debt

The nonpartisan Congressional Budget Office released its analysis of tax-reform legislation now under consideration in Congress. According to the CBO, the House plan would add roughly $1.7 trillion to the U.S. debt over 10 years. The Senate plan was still being analyzed at press time.

The decade-long spike in annual deficits would increase the national debt by 6 percent over a decade, after which debt would nearly equal the nation’s gross domestic product, according to a letter to Congress by CBO Director Keith Hall.

Both bills would keep tax exemptions for employer-sponsored health plans and retirement savings accounts, said Howard Gleckman, a senior fellow a the Tax Policy Center at the Urban Institute and Brookings Institution, a Washington, D.C.-based think tank.

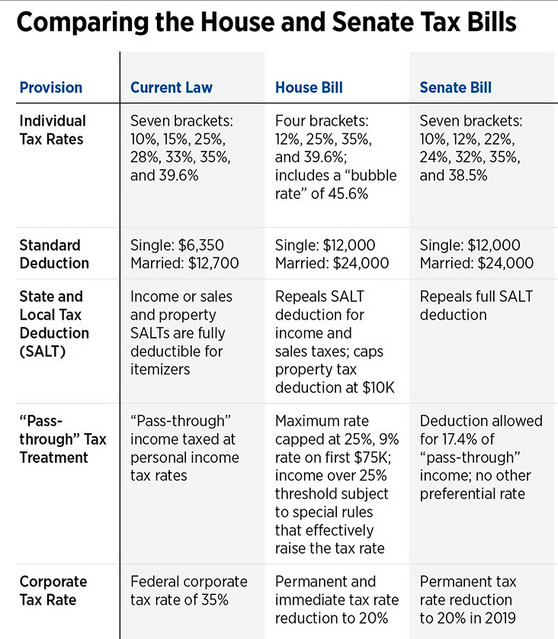

The House bill would repeal most of the state and local tax deduction, but retain a limited deduction of $10,000 for property taxes. The Senate bill would scrap the deductions entirely. The House bill would impose new caps on mortgage interest deductions, while the Senate bill would end them. The House bill would end the deduction for medical expenses, while the Senate bill would retain it, Gleckman said.

Both bills would cut corporate income tax rates and tax rates on pass-through businesses, such as partnerships, from 35 percent to as low as 20 percent.

The standard deduction for average tax filers would be doubled, but itemized deductions, such as those for property taxes and mortgage interest, would be limited or eliminated, Gleckman noted. The tax cuts “would primarily benefit businesses and high-income households,” he said.

Impact on real estate market

The Long Island Association of Realtors is working on combating the elimination of the property tax deduction. Many real estate agent have placed their names on online petitions, according to industry officials.

Marsha Ander, a branch manager for the Coach Realtors office in Hewlett, said that the bill just passed in the House, could be “detrimental to the Long Island housing market, especially in the Five Towns and surrounding areas.”

“Its obvious that it will impact our market since it’s commonplace to see starter homes with taxes thousands over the proposed cap,” she said. “A tax system that favors renting over owning isn’t good for the economy and the future of home ownership. At this time, the thought of structural changes to our tax code has not impacted sales, rather lack of inventory in the Five Towns has slowed down out market considerably.”

V.I. Properties owner Natayla Mikenberg doesn’t believe that that doing away with the deduction will have much of an impact whether people are buying a $2 million or a home selling for much less. “Prices are always high, taxes are also high, but we have STAR that is usually around $1,700,” she said.

STAR, which stands for School Tax Relief Program, is a New York state initiative that gives households with an income under $500,000 an exemption from the first $30,000 of the full value of their primary home from school taxes. Homeowners 65 and older get a larger tax break for Enhanced STAR: The first $65,300 of their home value is exempt from school taxes.

The Senate bill has yet to come to the floor for a vote as of press time. A unified bill is expected to be sent to President Trump’s desk for signing before Christmas. Trump made tax reform, in particular simplifying the tax code, a centerpiece of his 2016 campaign and is banking on passing legislation this year to bolster his declining poll numbers, according to a number of pundits.

39.0°,

Fair

39.0°,

Fair