School district budgets: rock or hard place?

After hearing Gov. Andrew Cuomo’s budget release in early February, the Sewanhaka, Franklin Square and Elmont school districts have been on their feet, working to incorporate heavy school aid cuts and a proposed 2 percent property tax cap into their budgets. The tax cap, which was recently passed by the Senate and would take 76 of 150 votes in the Assembly to fully pass, wouldn’t go into effect until 2013, but districts are preparing ahead of time.

Sen. Jack Martins, (R-Elmont), said the tax cap was necessary for the state due to the heavy tax burden currently on New Yorkers. High property tax increases in recent years have made it increasingly difficult for people to stay in New York, or move to the state, Martins said.

“In order to make government work again for the people, we need fiscal discipline and commitment to initiatives like a tax cap. Government has to take a lesson from the kitchen table budgeting of working families and ignore special interest budgeting,” Martins said. “The governor’s budget is a very sober assessment of the state of New York’s finances. I’m pleased that he has recognized the seriousness of our budget problem. I’m also glad to see that his answer is to not tax his way out of the recession.”

However, local school districts would take huge budget hits if the cap were passed, and local districts have been keeping the cap in mind throughout budget planning.

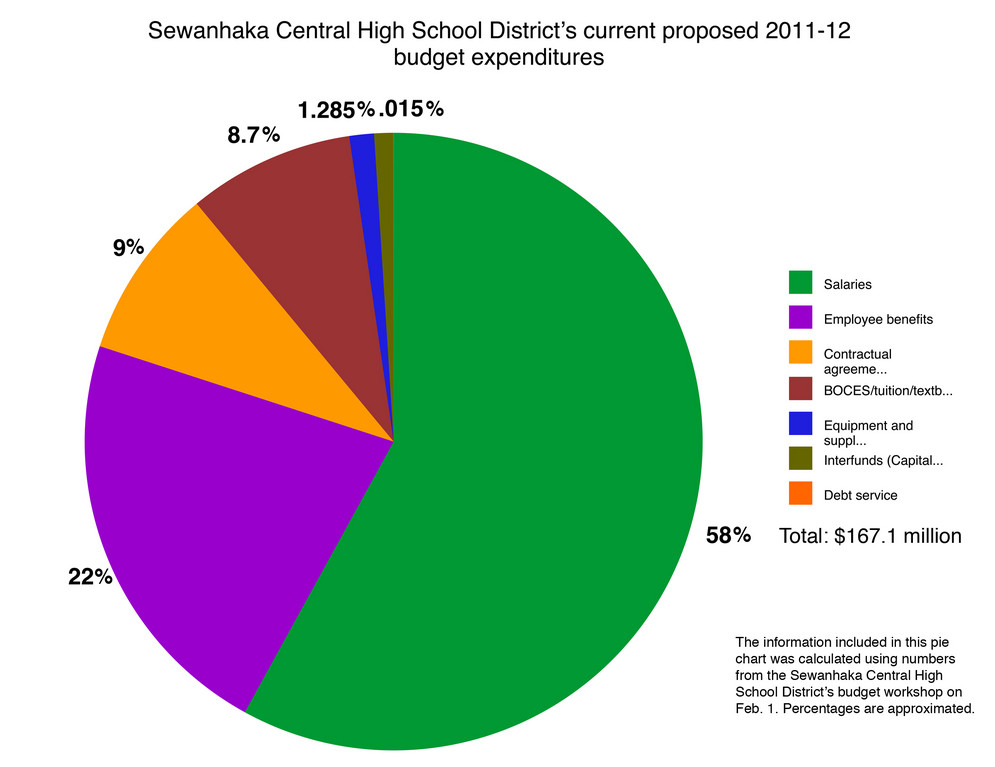

The Sewanhaka Central High School District’s current proposed budget is assuming a 5 percent cut in state aid, leading to a more than $1.4 million cut in state sources for 2011-12. The budget also proposes a decrease of $85,000 from local sources from this year’s budget to 2011-12’s.

Sewanhaka’s proposed budget includes a tax levy increase of nearly 12 percent; the budget’s 2010-11 tax levy was around $120.5 million, while its 2011-12 budget tax levy is proposed to be nearly $134.9 million.

63.0°,

Mostly Cloudy

63.0°,

Mostly Cloudy