Mandates, pensions and health care — oh my!

Lynbrook presents tentative $35.42 million spending plan

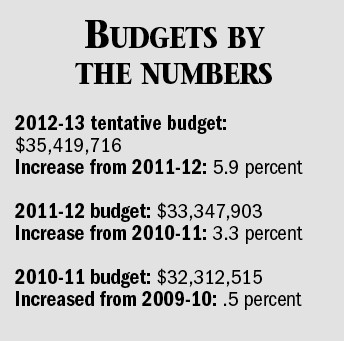

Citing unfunded state mandates, rising pension and health care costs, police retirement expenses and a 5 percent drop in revenue, Lynbrook village officials have unveiled a 2012-13 tentative budget of just over $35.4 million, 5.9 percent larger than the current spending plan.

More than $14 million, or 44.1 percent, of the budget is earmarked to cover police expenses. As an example, four members of the Lynbrook Police Department are eligible for an estimated $720,000 in severance pay, but according to a message posted on the village’s website, there is no remaining reserve revenue available in that designated fund to offset the severance expenses, which means they must be paid out of the general fund reserves.

As it stands now, the village’s increase in the tax levy — the total amount of money to be collected in property taxes — will increase 6.89 percent, the same as last year. In October, the board voted to override New York state’s new 2 percent tax levy cap so that it would be able to fund, among other items, employees’ mounting pension and health care costs, which have risen by an estimated $425,000 since the current budget was formulated. Despite the override, the village preserved its AA bond rating from Standard & Poor’s, Village Administrator John Giordano said.

Village taxes make up 35 percent of a resident’s property tax bill, while school taxes account for 55 percent and the Town of Hempstead, 10 percent. Village taxes are used for highway maintenance, building code enforcement, fire and police services, parks and recreation, the public library and trash collection.

The village plans to use $2.14 million of its budget reserves — an increase of nearly $593,000 over the current year — to offset the 5 percent decrease in revenue, in part due to diminishing interest earned on idle village funds and a decline of mortgage tax revenue. This would leave an estimated $2.9 million in reserve for future use.

In this year’s budget, statewide premiums for employee and police pensions increased by $547,000. The 2012-13 budget has a smaller increase in these premiums, $127,274. Officials said that the premiums should continue to stabilize in coming years, and will have less of an impact on the 2013-14 budget.

Hendrick explained that the board can adopt a budget any time before May 1, though there is much to be discussed before that date.

60.0°,

Mostly Cloudy

60.0°,

Mostly Cloudy