Hochul’s budget proposal viewed favorably by local leaders

Governor applauded for not raising taxes

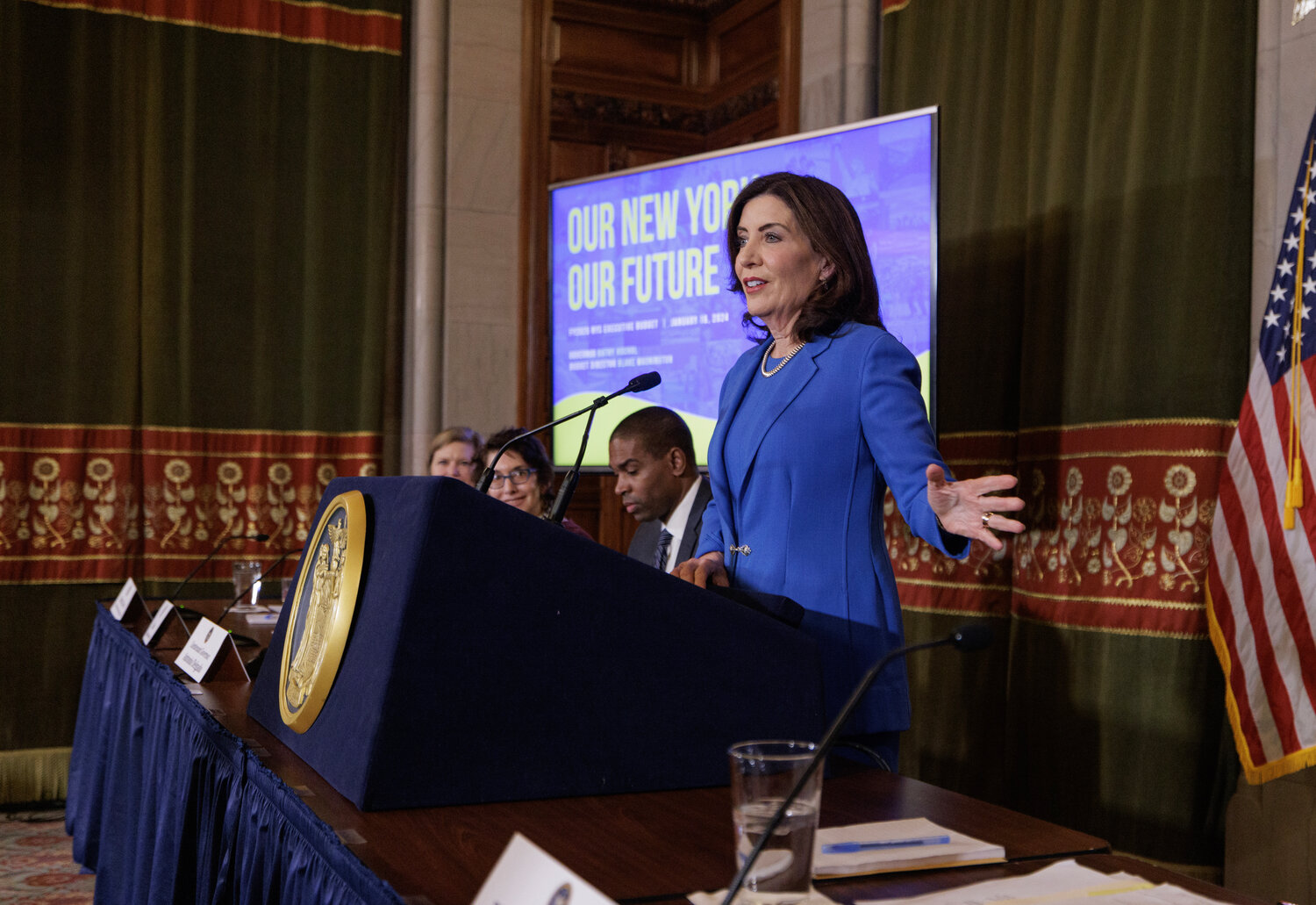

Gov. Kathy Hochul unveiled her recommendations for the fiscal year 2025 budget on Jan. 16.

Boasting a plan to improve economic development while addressing the migrant crisis and focusing on “people first” policies, Hochul’s office claimed that her spending recommendations would result in dramatic quality-of-life improvements for state residents.

“This budget makes it clear that fiscal discipline can co-exist with progressive, people-driven policies,” the governor said in a statement. “I am committed to fight the right fights on behalf of New Yorkers, and to pursue the common good with common sense — by seeking common ground.”

The balanced budget proposal includes record investments in such things as infrastructure — with more than $435 million allocated for flood recovery and “resiliency projects” alone — and education. There is $35.3 billion for school aid, up $825 million from last year, making it the highest investment in state education in New York history.

Most notably, though, there is no proposed increase in property taxes, which pleases Ashley Ranslow, the state director of the National Federation of Independent Businesses, the nation’s leading small-business advocacy association.

Ranslow is keenly aware that small- to medium-sized businesses, or SMBs, can find themselves in a precarious position when taxes of any kind are increased, and she said she was pleased that Hochul’s proposal stabilizes property taxes for those who have home-based businesses.

"NFIB applauds Governor Kathy Hochul for standing by her pledge to not increase income taxes to balance New York State’s Budget,” Ranslow said in a statement. “Facing a $4.5 billion budget deficit, there have been calls to increase income taxes, an incredibly misguided approach that would hurt the state’s economy, small business owners, and exacerbate the outmigration of New Yorkers and their tax dollars. The Governor’s rejection of income tax increases is the prudent and responsible course of managing the state’s finances.”

All-funds spending in the proposed budget would be $233 billion, growing 4.5 percent. Hochul prioritized bolstering the state’s reserves, which currently sit at just over 15 percent of operating costs. Under her leadership, the state maintained a bond rating of AA+, reducing borrowing costs.

Such factors make New York an attractive place for small businesses, with potential rewards outweighing risks. Hochul specifically addresses small-business needs in her recommendations, with a proposed $40.2 million to address retail theft and bring relief to small businesses, and $5 million for the Commercial Security Tax Credit to help business owners offset the costs of that theft.

Cannabis business owners, too, can take comfort in knowing that Hochul will introduce new legislation to strengthen cannabis laws, helping the Office of Cannabis Management and local governments seal or padlock unlicensed businesses.

For Ranslow, too, balancing the budget is key to helping SMBs across the state thrive, even in the face of increasingly uncertain times.

“The Governor’s budget also advances pro-small business policies that will provide much-needed financial relief to Main Street,” her statement continued. “The budget proposes to finally sunset the outdated COVID sick leave law, which was never intended to be permanent, saves hardworking small business owners from being robbed by trial lawyers for wages already paid to manual workers, and cracks down on the dramatic increase in retail theft incidents.

“NFIB commends the Governor for incorporating small businesses’ top priorities and protecting Main Street,” Ranslow added, “at a time when it is becoming increasingly difficult to keep the doors open for employees, consumers, and communities. Members of the New York State Senate and Assembly should support the Governor's efforts to assist New York’s small businesses and the state’s economy by advancing these items in the final budget agreement.”

Hochul’s budget recommendations will now go to the State Legislature, which will begin the process of crafting a spending plan.