This is how tenants, homebuyers can get ahead

Purchasing a home can be an exciting yet daunting task — involving, as it does, finding out how to afford a down payment, finance a mortgage and secure approval.

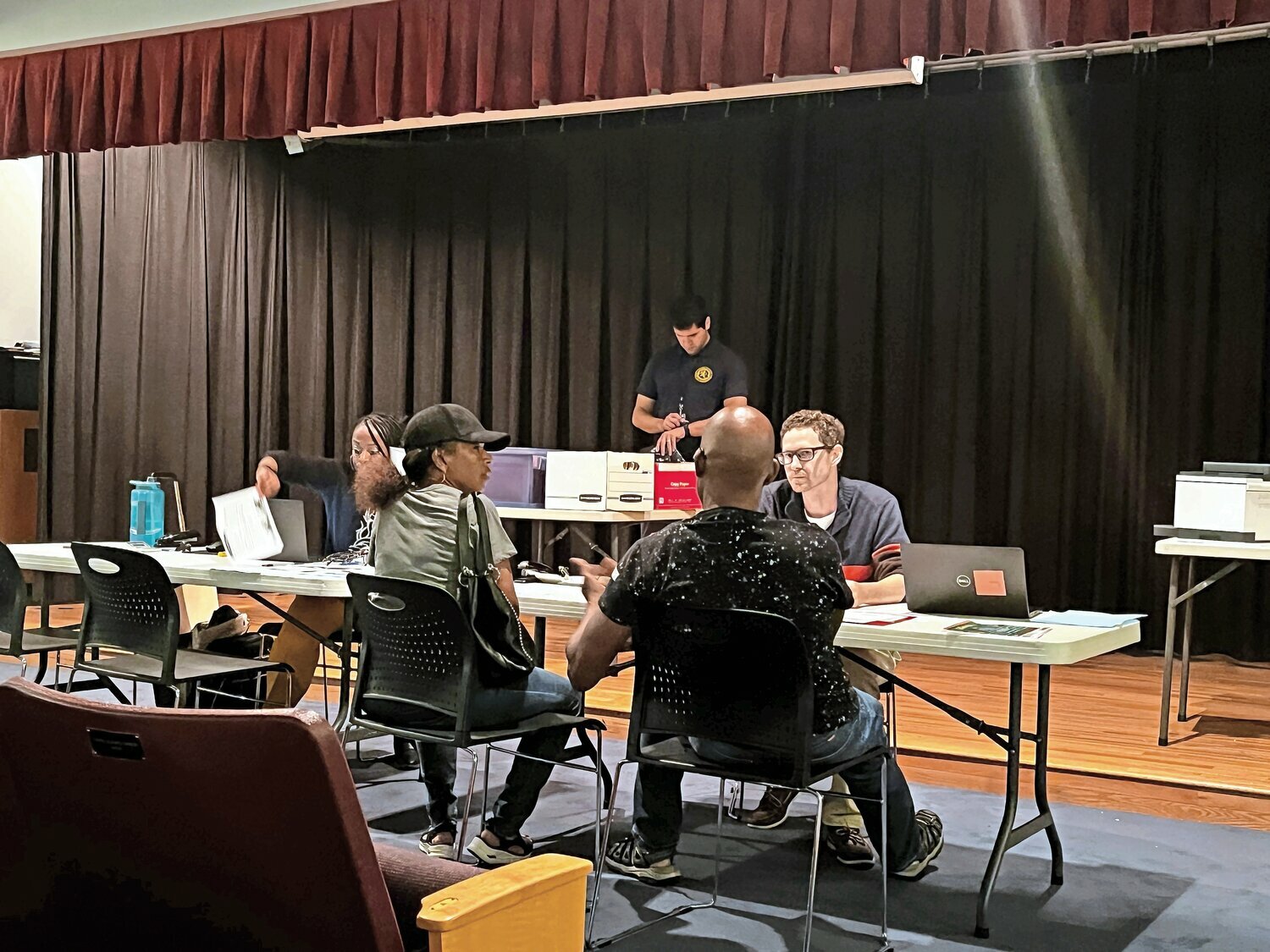

Prospective and current homebuyers are invited to ask questions at two local workshops this month to prepare them for the house hunt. The sessions will be held in Elmont and Valley Stream, and their aim will be to educate residents on their rights and programs available to help finance a mortgage.

The workshop in Elmont, co-hosted by Nassau County Legislator Carrie Solages, will be held at Elmont Memorial Library on Sept. 13, from 7 to 8:30 p.m. The Valley Stream workshop, co-hosted by Assemblywoman Michaelle Solages, will take place on Sept. 14, from 6 to 8 p.m., at VFW Post 1790.

At the Elmont workshop, real estate professionals, the State of New York Mortgage Agency and the Long Island Housing Partnership will share tips with prospective homebuyers on the best financial practices and navigating the home-buying process.

“We’re educating people on different programs available to them to help purchase a home,” Carrie Solages said, “but also keeping their home, understanding the assessment system, (and) understanding your rights as to how and when you can challenge an assessment.”

The Valley Stream workshop will feature representatives from Community Development Corporation Long Island, the state’s mortgage agency and Long Island Housing Services, and offer information on tenants’ rights as well as buying a home.

Even if a home purchase isn’t in the cards in the upcoming months, the workshops can help prospective buyers strategize. “Having that counseling session can help them get on the right road and give them realistic expectations for what that process would be like,” said Darrelle Forde, senior vice president of single-family programs with the state’s mortgage agency.

The agency helps residents who are at or below certain income levels purchase their first home. No minimum credit score is required to apply for its down payment assistance programs. However, credit profiles are reviewed to see that payments can be made on time.

Down payment assistance loans acquired through the agency are non-repayable and are forgiven after the homeowner lives in a house for 10 years. Between January 2021 and June 2023, the agency provided about $11 million in non-repayable down payment assistance across Long Island.

The cap for the down payment assistance is 3 percent of the purchase price of a home, or $15,000. The minimum out-of-pocket contribution from homebuyers is 1 percent of the closing cost. Subsidies from nonprofits, employer assistance programs and the state agency loan can be stacked to help a buyer afford the total down payment.

In that same time period, the mortgage agency produced 1,040 loans across Long Island, and 70 percent were made to households that earned at or below 80 percent of the area median income.

In Nassau County, the income limit to apply for the low-interest rate program through the mortgage agency is $184,000 for single or two-family homes and $215,000 for homes housing three or more families.

Additionally, the agency offers renovation loans for “zombie homes” that have negatively affected property values. Through this process, the agency interviews contractors to perform the renovations, and the contractors then report to a bank that makes sure they stay on schedule and within budget.

While the state process can take a bit longer than conventional loan services, Natasha Williams, a Cornelius Group real estate broker, said it’s worth it. Her clients have received grants and lowered their mortgage interest rates.

“These are opportunities, even when we’re considering a high interest rate market, where people can actually be on top,” Williams said.

While some people look to acquire a home, others struggle to keep theirs. At the Elmont workshop, a foreclosure prevention attorney from Long Island Housing Services will help homeowners understand their rights in the process.

Ian Wilder, housing services’ executive director, said it’s in the homeowners’ best interest to seek expert help when facing foreclosure.

“You may not realize what your rights are unless you have somebody who works on this process every day and knows what the rules are,” Wilder said.

Wilder has counseled tenants and homeowners who have faced foreclosure, and stressed the importance of seeking help early on. The biggest problem the service has is clients who call too late.

“Waiting is never the best option,” Wilder said. “There are people out there who are already compensated by grants at no cost to you who do this every day — call them as soon as possible.”

For more information about the Elmont workshop, contact Carrie Solages’ office at (516) 571-6203 or at CSolages@NassauCountyNY.gov. For more information about the Valley Stream workshop, contact Michaelle Solages’ office at (516) 599-2972 or District22@NYAssembly.gov.

“It’s an excellent opportunity to ask lots of questions, and there’s no such thing as a stupid question,” Forde said.

43.0°,

Partly Cloudy

43.0°,

Partly Cloudy