Island Park keeps village taxes in check

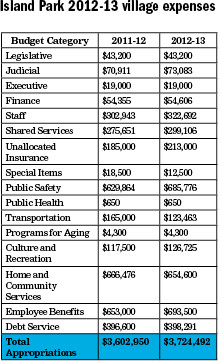

Island Park residents will only see a slight tax increase next year from the village’s $3.7 million budget, which passed unanimously on April 19 with a tax increase of 1.25 percent.

Island Park managed to keep its spending increases small for the next fiscal year, expanding the budget by only $121,500. The tax levy will grow by less than $33,000, or 1.45 percent. That means a tax increase of 39 cents per $100 of a household’s assessed valuation — or, as Island Park Mayor James Ruzicka put it, about $20 for the average household.

One of the reasons for the nominal increase in next year’s spending plan, Ruzicka said, was because, many years ago, the village under-budgeted certain items. When this was discovered during a state audit, the village had to start increasing those line items more to bring them in line with actual expenditures.

“Last year and the year before, we were bringing our budget up to reality, and we’re at that point,” Ruzicka said. “We’re at the point where I’m comfortable with the numbers that we’re putting forth, and it should be good for this year and next year, too.”

Expected revenues are also helping to keep the budget increase low. “There are a couple of items that we’re banking on,” said Ruzicka. “One is a FEMA return for Hurricane Irene. That’s going to help us out a lot.” The village budgeted $80,000 from the Federal Emergency Management Agency.

Though the total budget increase was low, there were some large increases. The village is increasing its spending for the Fire Department by about $50,000. Most of that comes from jumps in fuel budgeting and building and equipment maintenance.

The village is also increasing the salaries of many employees. Due to reduced staffing in some areas, however, the raises are budget-neutral. “Many of our employees are really low paid,” said Ruzicka. “You’re talking about $24,000 a year. So we felt that it was necessary to bring them up a bit.”

In addition to approving the budget, the board also voted to exceed the 2 percent cap on the tax levy increase recently enacted by the state. Although the budgeted tax levy increase is well below 2 percent, Ruzicka explained that the board voted to exceed it as an insurance policy.

“If we didn’t vote to override and the state came back with an audit and said, ‘You guys made a mistake here’ or ‘You didn’t calculate this right,’ then we all of a sudden could have seen a 3 percent instead of a 1.4,” he said. If that caused the tax levy increase to go above 2 percent, that excess would be held in reserve by the state.

“We’re dealing with small numbers,” Ruzicka said. “So a couple of thousand either way could mess us up.”

63.0°,

Partly Cloudy with Haze

63.0°,

Partly Cloudy with Haze