Tax cap to limit school budgets

School districts are feeling squeezed by this year’s tax cap.

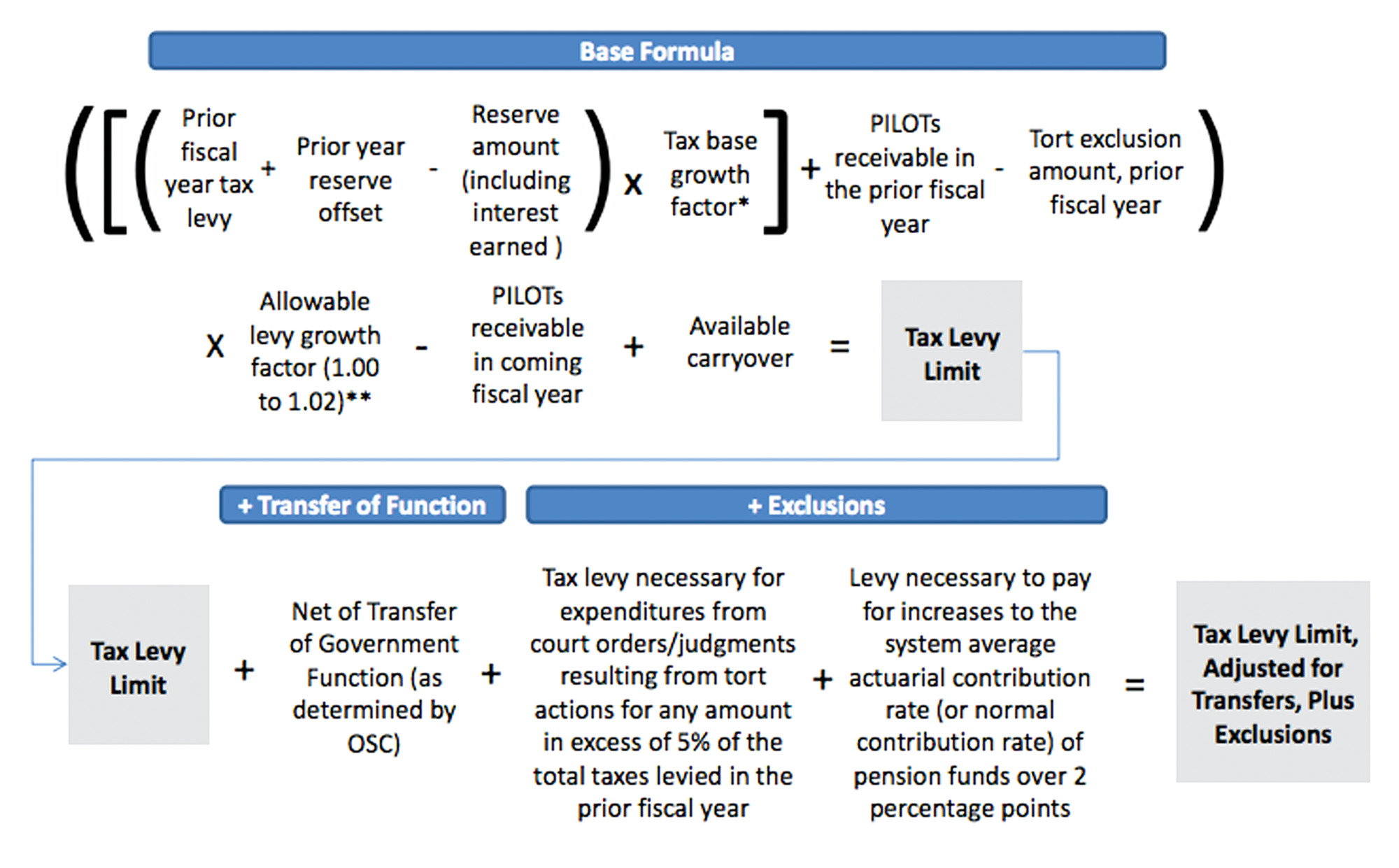

Since 2012, the state tax cap has limited municipal tax increases to approximately 2 percent or the rate of inflation — whichever is lower. Last week, State Comptroller Thomas DiNapoli announced that the allowable tax levy growth, which is tied to the inflation-measuring Consumer Price Index, would be .12 percent. This is the lowest allowed increase since the tax cap became law.

Such a small allowable increase in taxes will constrict school district budgets as salary, pension and insurance costs increase.

“The low cost-of-living allowance … permitted by the NYS tax cap legislation will, of itself, allow for a mere $37,000 of inflationary increase,” Island Park Superintendent Rosmarie Bovino wrote in an email, referring to the school district budget. “However, where will the revenues support even this modest increase?”

She added that according to the preliminary state budget provided by Gov. Andrew Cuomo, Island Park is set to receive only $13,360 more in state aid in 2016-17 school year than it got this year — a total of $2.3 million.

“It’s really at a dire crossroads,” said Oceanside Superintendent Phyllis Harrington. “We will have to seriously look at reductions in the programs.”

Districts can exceed the tax cap in their budget plans, but those that do will need a supermajority of at least 60 percent of voters to approve that spending. Harrington said that the district might consider exceeding the tax cap in the future, but right now she is hoping that the district will have more money available thanks to a reduction in the Gap Elimination Adjustment that Cuomo pledged in his State of the State address earlier this month.

In 2009-10, the state began taking away school aid to fill in budget holes. State Senate Majority Leader John Flanagan said he wants to end the GEA this year, but Cuomo has said that ending it would take two years.

In the initial budget, Island Park and Ocean-side are set to see reductions in the adjustment of $43,661 and $477,030. The two school districts are “owed” $140,505 and $1.5 million, respectively.

Harrington said that the budgeting process is being hit from multiple sides, what with barely growing state aid, the GEA and the low allowable tax levy increase, while the district is being asked to maintain $3.25 million in reserve funds. When reserve funds fell below that total, the district was added to DiNapoli’s susceptible-to-fiscal-stress list, and its Moody’s rating went down.

Oceanside will begin budget workshops next month, with the first one scheduled for Feb. 9, at 7:30 p.m., at School No. 4. Island Park’s next budget workshop is on Feb. 8, at 7:30 p.m., at the Conference Center across from Hegarty School, and a tax levy calculation presentation is scheduled for Feb. 22, at 7:30 p.m., also at the Conference Center.

50.0°,

Mostly Cloudy

50.0°,

Mostly Cloudy