Critical year for flood zone residents

Reduced insurance rates expire after 2012

2012 is an important year for Valley Stream residents living in the high-risk flood zone. It’s the last year in which homeowners can renew their flood insurance for a reduced rate before annual premiums spike back up to four figures.

Before than happens, residents say, they hope the federal government comes through with legislation that would either reduce rates or remove Valley Stream from the flood zone entirely. “We’re no better off than we were this time last year,” said Gibson resident Carol Crupi. “To say I’m a little disappointed is an understatement.”

Legislation never materialized in 2010. The Flood Insurance Reform Priorities Act, which would have included a five-year moratorium on the new flood maps, was passed by the House of Representatives but never made it to a vote in the Senate. When 2010 ended, the bill died.

Legislation written in 2011, however, could still be passed in 2012 because it is the same session of Congress, said Jessica Montgomery, a spokeswoman for Rep. Carolyn McCarthy.

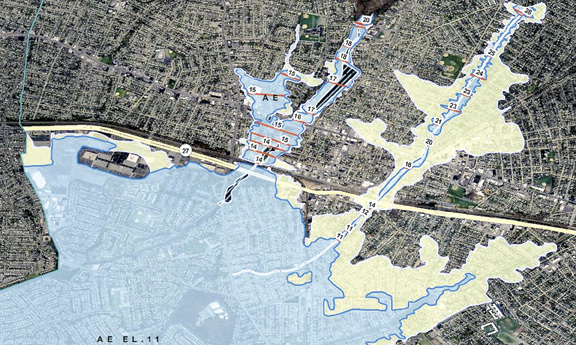

Last July 13, the House passed the Flood Insurance Reform Act of 2011, which included five years of reduced insurance rates. The bill has yet to make it to a vote in the Senate. Neither did the Flood Insurance Reauthorization Modernization Act of 2011, supported by Sen. Charles Schumer, which would require the Federal Emergency Management Agency to take a second look at its maps in the Jamaica Bay flood zone, which includes Valley Stream.

Last week, Mayor Ed Fare wrote a letter to McCarthy, Schumer and Sen. Kirsten Gillibrand, encouraging them to pursue meaningful legislation this year. Fare wrote that village officials believe that the new flood maps, which took effect in September 2009, are invalid.

The most desirable legislation would remove Valley Stream entirely from the flood zone. Fare said. “That would be ideal,” he added.

If a permanent solution cannot be found in 2012, he said, at minimum, the moratorium on rates should be extended. Homeowners added to the flood zone in 2009 were eligible to renew their policies in 2011 and 2012 at the reduced Preferred Risk Policy rate, about $400 annually — “A gift, I guess,” Crupi said.

66.0°,

Mostly Cloudy

66.0°,

Mostly Cloudy