Higher flood insurance rates loom

With moratorium ending in six months, federal representatives seek extension

Three federal lawmakers are calling on the Federal Emergency Management Agency to extend lower flood insurance premiums for residents added to the high-risk flood zone in 2009, with a rate reduction set to end in six months.

Thousands of homes in Valley Stream, primarily in the Gibson section, were added to the flood zone when the new maps took effect in September 2009. Homeowners with federally backed mortgages were required to purchase flood insurance, which for many cost as much as $2,000 a year.

After a public outcry, FEMA enacted a two-year moratorium on the higher rates, and allowed residents to renew their insurance in 2011 and 2012 at the Preferred Risk Policy rate of about $400 per year. Those lower rates are set to expire Dec. 31.

U.S. Sens. Charles Schumer and Kirsten Gillibrand, along with Rep. Carolyn McCarthy, are asking FEMA to extend the lower rates, at least until a remapping of Queens and Brooklyn, called the Jamaica Bay study, is completed and new maps are finalized.

“Nassau families should not have to shoulder the financial burden of exorbitant flood insurance costs for homeowners,” Gillibrand said. “It is critical that FEMA extend the subsidized policies for Nassau homeowners until a decision on the Jamaica Bay flood maps is reached.”

McCarthy said that an extension of the lower rates is “simply the right thing to do.” She and Schumer agreed that rates should not be raised while more accurate data is being gathered.

Last month, representatives of the three lawmakers met at Valley Stream Village Hall with Mayor Ed Fare and other village officials. Fare said he urged the representatives to extend the lower rates indefinitely until a solution is found that eases the burden on local homeowners. “We can’t wait,” he said.

He added that with lower rates in place for the long term, FEMA would have time to redo its flood maps using the best available science, and lawmakers would have time to craft legislation that would give homeowners some relief.

In 2011, the House of Representatives passed the Flood Insurance Reform Act that was co-sponsored by McCarthy, but the bill never made it out of the Senate. Fare acknowledged that a solution can only be found at the federal level, which is why he said he has reached out on numerous occasions to Schumer, Gillibrand and McCarthy.

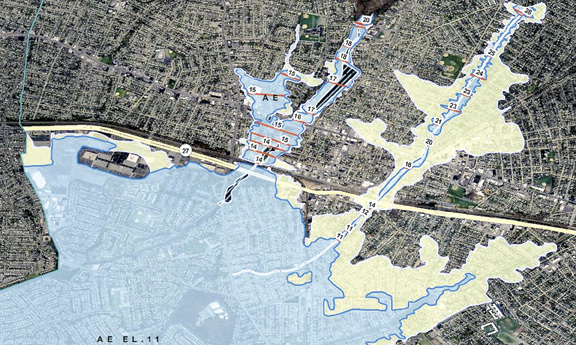

Fare said it concerns him that New York City was not included in the 2009 mapping study, and that homeowners on the south shore of Queens are spared mandatory flood insurance, while those in Valley Stream have to pay. “The water is going to stop at the city line?” he asked.

There are solutions that village officials would and would not deem acceptable as a long-term fix of the problem, Fare said. “The best-case scenario is everyone’s out of the flood zone,” he said. “The worst-case scenario is everything stays the same.” Some of the acceptable solutions fall somewhere in the middle, he added.

Gibson resident Carol Crupi, president of the Valley Stream Community Association and a leader in the fight against the flood maps, said that an extension of the lower rates would be a small victory, and it is disappointing that, after two years of public outcry, no permanent solution has been found.

“What our politicians are doing is kicking the can down the road,” Crupi said, adding that home values in the flood zone are suffering. “Every homeowner affected must challenge their taxes as long as we remain in these incorrect maps.”

In a letter to FEMA administrator William Fugate, Schumer, Gillibrand and McCarthy noted the impact the flood insurance premiums have on a homeowner’s ability to sell his or her house.

Before the new maps went into effect, the base flood elevation for Valley Stream — the height above sea level where the ground meets a house — was eight feet. That meant that only homes below that level were included in the flood zone. When the base flood elevation was raised to 11 feet in 2009, thousands more homes were suddenly in the high-risk flood zone. Crupi said that any new maps should be based on the eight-foot level, and that historical flood data must be taken into account. Otherwise, “these maps will continue to be wrong,” she said.

Fare noted that there are other areas of Nassau County — and the U.S. — that are in the same situation. On Saturday, he hosted a meeting involving officials from the Town of Hempstead and other South Shore villages to discuss possible courses of action. Ideas included a class action suit against FEMA, forming a consortium of municipalities to limit future insurance rate hikes and demanding that the Preferred Risk Policy rates be continued beyond this year.