Long Beach School District floats 2012-13 budget

$122.1 million spending plan includes tax levy increase to fund bond payments

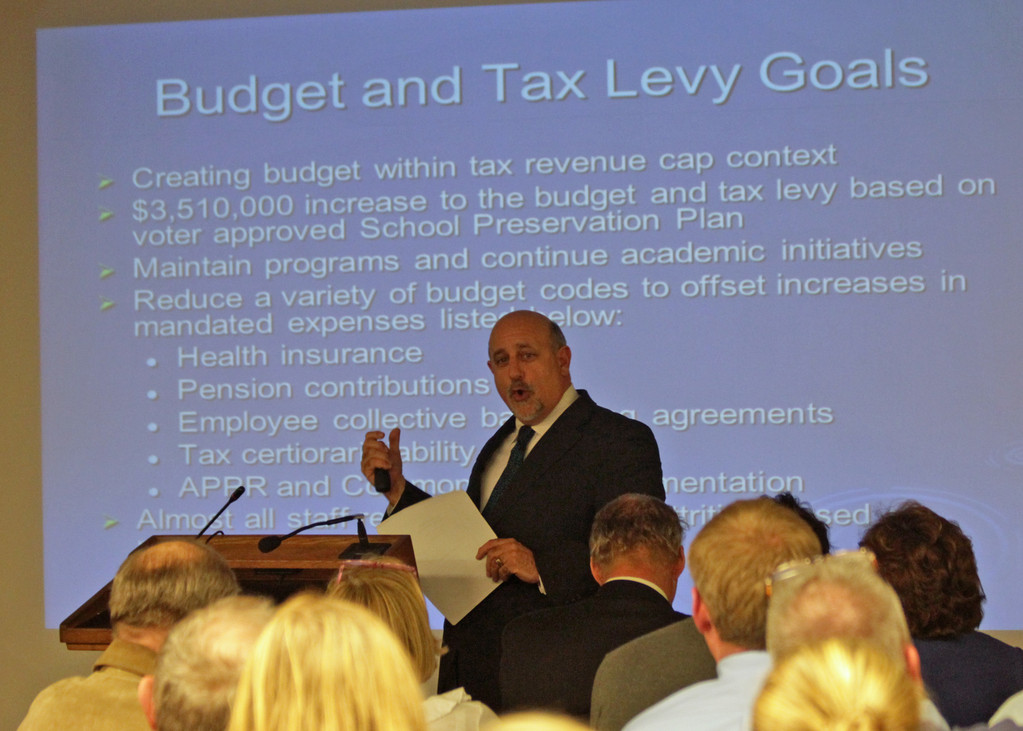

Residents were given a first glimpse of the Long Beach School District’s preliminary 2012-13 budget on March 13, when district officials presented a draft of the spending plan to the Board of Education and public. The $122.1 million budget — a 2.9 percent increase over the current spending plan — maintains programs and holds the line on operating costs, but includes staff reductions and a slight increase in class sizes, mainly at the middle school.

A crowd of more than 100 attended the presentation, at the Long Beach Public Library. The tentative budget, which goes before the board for adoption on April 17, includes a 3.9 percent increase in the tax levy — the total amount the district needs to raise through property taxes — that will help reduce the principal the district owes on a $98 million bond to fund its school-preservation plan, a district-wide initiative to upgrade schools and facilities approved by voters in 2009.

“[I]t’s time to pay back the money on the debt service to the bond,” said Michael DeVito, the district’s chief operating officer. “… [W]hat we’re asking taxpayers to pay for additionally is just the principal that we have to pay next year on the bond.”

DeVito said that the district is allocating about $3 million from the district’s reserve fund to help offset the levy.

“The district actually operated at a bit of a surplus in the prior year,” he explained. “We spent a little less and took in a little more, and we’re now going to give that back to you — we’re going to use that to offset what we’re asking you [for] in the tax levy for the next year.”

Though school districts are facing a state-mandated 2 percent cap on their tax levies, there is an exemption in the law for capital projects such as the district’s preservation plan. After factoring into the budget a yearly $3.5 million payment to fund the plan, school officials determined that the allowable tax levy cap limit is actually 5.2 percent.

Under the tax cap law, any school budget that increases the tax levy by more than 2 percent requires a supermajority, or 60 percent, vote to pass. But with Long Beach’s exemption, as long as the tax levy increases by no more than 5.2 percent, passing the budget will require only a simply majority.