New flood maps draw ire in Gibson

The Federal Emergency Management Agency’s recently redrawn flood maps have created some consternation among residents in the Gibson section of Valley Stream, who say they have never experienced flooding but are being forced to purchase flood insurance.

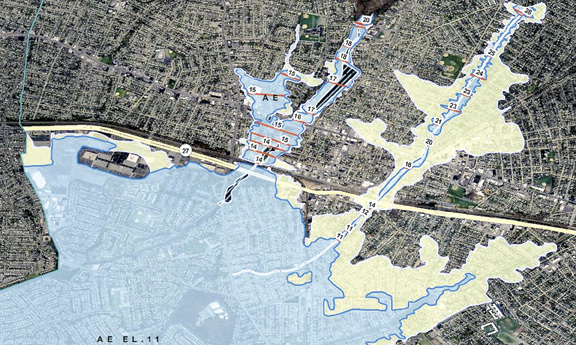

The new flood maps — which determine whether homes are in a designated flood zone, and force those homeowners with mortgages to purchase flood insurance — went into effect last September. Gibson Boulevard and much of the surrounding area is now a designated flood zone.

Flood insurance can cost upward of $2,400 per year, and Gibson resident Carol Crupi said it is an unfair burden. “We are being hit with an unfair tax,” Crupi said. “FEMA needs to fill its coffers. They need the money. People are being put in the flood zone that don’t belong, and we’re suffering.”

She added that trying to sell a home in a flood zone is particularly difficult. “The Long Island homeowner is at the point of breaking,” Crupi said. “This is the straw that broke the camel’s back.”

FEMA’s National Flood Insurance Program requires homeowners in flood zones to have flood insurance, which is underwritten by the federal government. NFIP rates are based on such factors as a property’s elevation and whether its structure has a basement. If homeowners with mortgages opt to not purchase mandatory flood insurance, the bank that issued the mortgage will add the insurance to the homeowner’s mortgage payments.

Crupi, who has lived in Valley Stream since 2006, said that in the past four years there have been some severe storms, but her home has never flooded. “One of my neighbors has lived here for 60 years and never flooded,” Crupi said. “I’ve never had one drop of water in my basement.”

According to Barbara Lynche, a spokeswoman for FEMA’s Region 2, homeowners can challenge a flood zone ruling by filing for a Letter Of Map Amendment. Lynche explained that a homeowner can hire an independent surveyor to evaluate his or her property, in particular how high the first floor is above the flood elevation. If it is above the elevation, she said, the homeowner is removed from the flood plain map.

Flood zones are deemed at risk of flooding by coastal waters or during heavy rain storms, and the updated maps are based on more precise geographic and elevation measurements, according to FEMA. Lynche explained that FEMA determines the flood zones through a system called Light Detecting and Ranging Radar: officials fly over an area and shoot lasers down to the ground that bounce back up to the plane, which measures ground elevation.

She added that map modernization in Nassau County was done more than 30 years ago, and the flood zone maps needed updating. “When you change the topography of the land in terms of highways, housing, even shopping centers, the way the water flows and pools changes,” Lynche said. “These maps are based on the facts on the ground now, not 35 years ago. This was a systematic effort to bring flood maps to reflect what the development is right now.”

Lynche noted that homeowners who do not have mortgages and are in designated flood zones should consider buying flood insurance. In the event of a flood and a federal state of emergency declared by the president, she said, those without flood insurance would not receive assistance from FEMA.

April Turner, spokeswoman for U.S. Rep. Carolyn McCarthy, called the situation “a prickly one” and said that McCarthy is working on a bill to extend the amount of time a homeowner has to buy flood insurance. As of now the deadline is May 31. “It’s mandatory and it stinks,” Turner said of flood insurance. “We want to alleviate the pressure for people to buy mandatory flood insurance.”

60.0°,

Mostly Cloudy

60.0°,

Mostly Cloudy