Teaching scam identification to elderly residents

As scammers develop newer and more advanced methods of stealing from the vulnerable, elected officials are urging community members to learn how to identify scams.

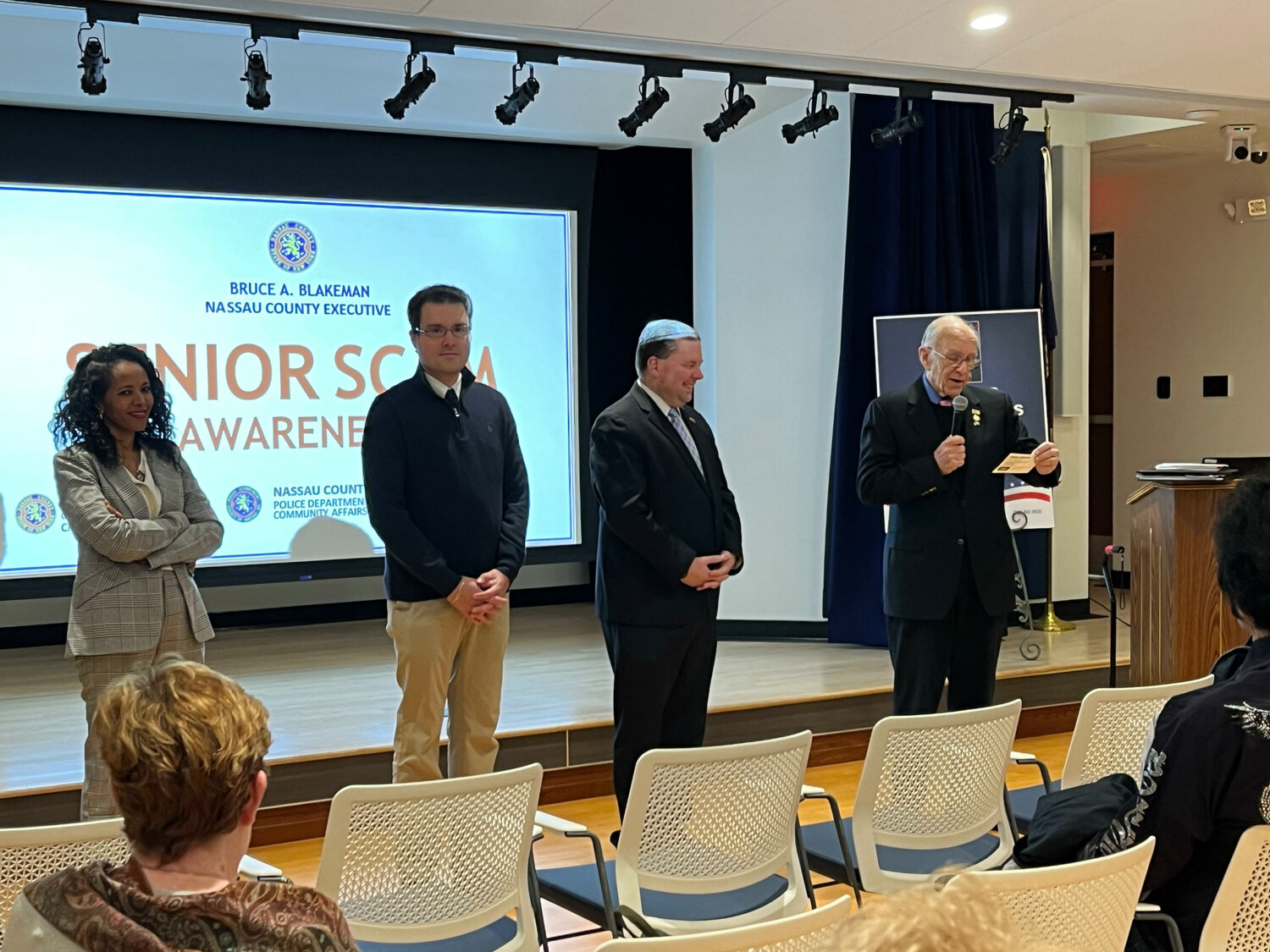

At Scam Prevention Seminar on Jan. 18 at the Levittown Public Library, which included experts from the Nassau County Police Department and representatives of victim services organizations. They spoke to attendees about how to identify and report a scam, as well as how to recover from one. Several state and county representatives sponsored the event, including Sen. Steve Rhoads, who said that as technology has grown more sophisticated, scammers have found new ways to deceive people into giving them their personal information, and making off with their money.

“Scam-prevention seminars are crucial in today’s digital age to equip individuals with the knowledge and skills to protect themselves from falling victim to scams,” Rhoads said. “It also provides a platform for individuals to ask questions, build a network of support, and educate others about the importance of scam awareness and prevention.”

Several elected officials spoke to the attendees about the importance of identifying scams. Assemblyman David McDonough showed just how common they are, displaying a flyer he had received in the mail, claiming that he had won a $100 reward. The flyer directed him to call a number on the back, but McDonough warned that scammers on the other end would try to trick callers into sharing personal information.

“Once you give them your Social Security number, forget it,” McDonough said. “Your identity is gone.”

He also stressed not putting too much information on checks, such as a phone number. Scammers, McDonough said, recruit “cashiers” to buy copies of checks they receive, and will call the people who wrote them. Using the checking account and routing number, scammers will say they are with a check writer’s bank, claim the account has been hacked and ask for more personal information.

“You’re giving them all the information necessary for them to scam you and steal your identity,” McDonough said.

Manda Kristal, the program coordinator for financial abuse and exploitation at the Family and Children’s Association, a nonprofit organization that helps vulnerable people on Long Island, said that mail scams are common, and scammers will also claim to be charity organizations asking for donations. In those cases, Kristal suggested going to charitynavigator.org, which will verify if a charity is legitimate.

“There are lots of evil people out there, and they are constantly conniving and trying to take advantage of people.” County Legislator Thomas McKevitt said.

Kristal said that phishing emails, in which scammers trick people into giving away sensitive information, will pretend to be your bank and message you that your account has been hacked. These types of scams use fear as a tactic, she said, so the victim will be more likely to give up information. Any time an email or phone call claims to be your bank, Kristal said, it is important to call your bank to confirm with them.

Grandparent scams, according to Kristal, have become prevalent, preying on the emotions of the elderly. In these cases, a scammer will call up a grandparent and pretend to be their grandchild, claiming they are in jail and need money for bail. In these situations, Kristal recommends sharing a password with family members. When a scammer pretends to be family, ask for the password and, she said, they’ll hang up, because scammers would rather move on to an easier target.

Scammers are using new technologies, such as artificial intelligence,” Kristal said, to make them harder to identify. AI is capable of cloning voices and images, which makes it easy for scammers to replicate a person’s voice or likeness. All the scammer needs are a few words of your voice, or photos, which they can get from voicemails, calls or pictures on the internet.

Assemblyman John Mikulin said that his grandparents simply don’t answer the phone, because, they say, virtually every call is a potential scam.

Kristal explained that scammers are organized and operate like businesses. They can use robocalls and “spoofing,” where they alter the caller ID, to act as legitimate organizations.

If your identity has been stolen, there are steps you can take, according to the county Office of Crime Victim Advocate, which offers services to victims and witnesses of a crime.

If you are a victim of identity theft, call the companies where the fraud occurred and freeze your accounts, and change logins and passwords. Check your credit reports, and report the theft to the Federal Trade Commission, either online, at idntitytheft.gov, or by calling its identify theft hotline, (877) 438-4338. Finally, file a report with your local police department and update your personal information.

According to Kristal, victims of a scam will only be more vulnerable, because they’ve proven that they are susceptible to giving up their personal info. “If you’ve been the victim of a scam,” she said, the probability of them coming back to you is very, very high.”