Looking at better ways to save school district money

Eliminating sales tax on purchasing school buses not the answer

The New York School Bus Contractors Association (representing over one hundred school transportation companies) is calling for a budget initiative that will help taxpayers and school districts save nearly $14 million per year — the elimination of the sales tax from school buses. Currently, school districts pay the state and local sales tax on the purchase of every school bus purchased by private operators as a portion of their transportation contracts.

School districts that utilize private school bus contractors pay, as a portion of their transportation contracts, the costs associated with the state and local sales tax. The state then reimburses the school district for the expense of the transportation contract not paid by school district taxpayers.

However Island Park Superintendent of Schools Rosmarie Bovino says the amount of savings would be small. She explained, “When Island Park purchases its own buses, we do not pay any sales tax. However, when school bus contractors (for profit businesses) purchase buses, they do pay sales tax. Naturally, they pass along the costs of new buses (including the sales tax) to the districts when they go out to bid. The amount of sales tax returned to districts is spread among all the districts that use the given bus.”

She said the tax monies are returned but as part of the entire state aid to transportation package, so it not a decipherable amount.

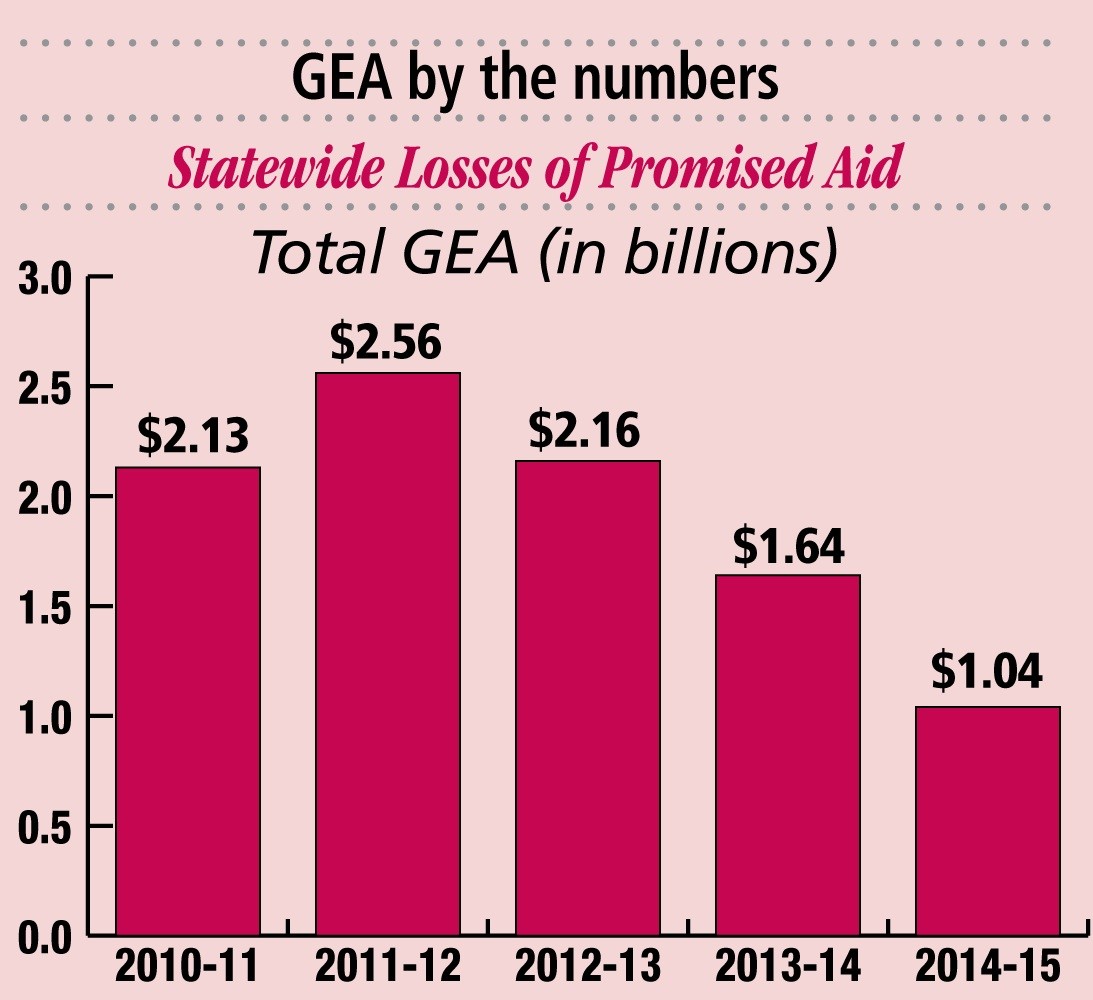

“This is simply a ploy by the bus companies to reduce their costs. They’re saying that the cost of the sales tax is passed onto districts, which it is, and that it costs taxpayers money, which it does.” Bovino adds the advantage of dropping the sales tax is questionable. “Would future bids from the NY bus contractors really be reduced if the sales tax is gone? I’m skeptical. I would much rather that the legislature entertains the idea of eliminating the Gap Elimination Adjustment (GEA) than divert attention to a sales tax for bus companies. The GEA cost LI school districts $218 million this school year (Island Park $226,578). This is decipherable and this would save taxpayers real money!”